Do you know how much you should be contributing to your 401k? Are you wondering if you’re saving enough for retirement? Understanding how to calculate percentage 401k is crucial for your financial future. In this post, we’ll explore the ins and outs of calculating percentage 401k and how you can ensure you’re on track for a comfortable retirement.

Planning for retirement can be overwhelming, but not having a plan can be even scarier. Many people aren’t sure how much they should be contributing to their 401k or how to calculate the percentage they need to save. The possibility of running out of money during retirement is a real pain point for many Americans, but it doesn’t have to be. By understanding how to calculate percentage 401k, you can take control of your finances and plan for a more secure future.

Calculating Your 401k Percentage

The first step in calculating your percentage 401k is to determine your contribution rate. This is typically a percentage of your salary that you contribute to your 401k each year. Most experts recommend contributing at least 10-15% of your salary to your 401k, but this number can vary based on your retirement goals and financial situation.

To calculate your contribution rate, divide the amount you contribute to your 401k by your annual salary. For example, if you contribute $5,000 to your 401k each year and your annual salary is $50,000, your contribution rate would be 10%.

Why Calculating Your 401k Percentage Matters

Calculating your 401k percentage is a crucial step in planning for your retirement. By understanding how much you need to save and how much you’re currently contributing, you can make changes to your spending and saving habits to ensure you’re on track to meet your retirement goals.

Additionally, knowing your contribution rate can help you make informed decisions about job offers and salary negotiations. If a potential employer offers a lower salary but has a more generous 401k matching program, you can weigh the benefits of the offer more accurately with your retirement goals in mind.

Factors That Affect Your 401k Percentage

Several factors can affect your 401k percentage, including:

- Your retirement goals and timeline

- Your current salary and earning potential

- Your expected retirement expenses

- Your 401k plan and employer’s matching policy

- Your other retirement savings accounts

It’s important to consider these factors when calculating your 401k percentage and making decisions about your retirement planning.

Maximizing Your 401k Contributions

If you’re looking to maximize your 401k contributions, there are a few strategies you can use:

- Contribute the maximum amount allowed by the IRS each year

- Take advantage of your employer’s matching contributions

- Consider catch-up contributions if you’re over 50 years old

- Adjust your contribution rate each year based on your financial situation and retirement goals

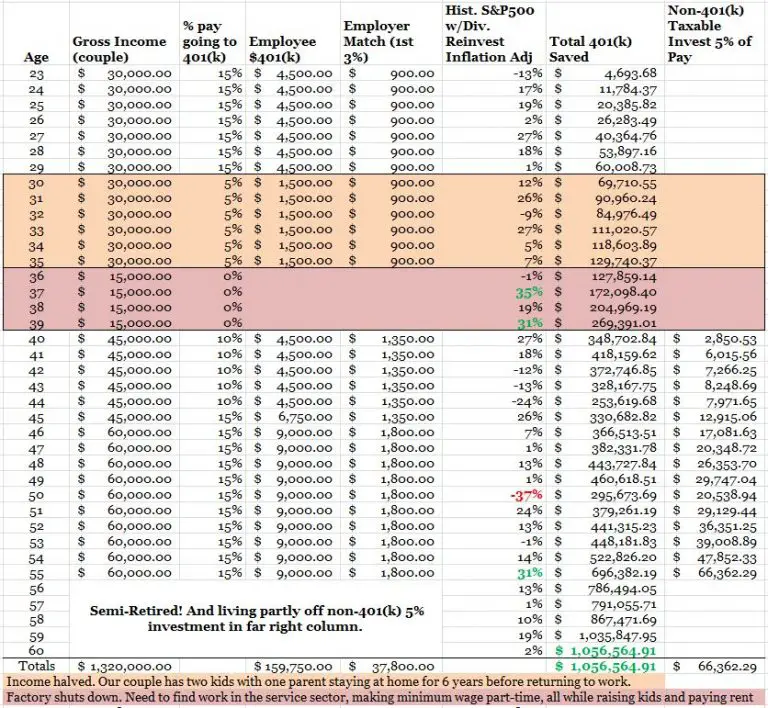

Case Study: John’s 401k Percentage

John is 35 years old and earns $60,000 per year. He currently contributes $5,000 to his 401k annually. To calculate his 401k percentage, he divides his contribution by his salary:

$5,000 / $60,000 = 0.0833 (or 8.33%)

John’s current contribution rate is 8.33%, which is below the recommended 10-15% for his age. He decides to increase his contribution rate to 12% to ensure he’s saving enough for retirement.

Question and Answer

Q: How much should I contribute to my 401k?

A: Most experts recommend contributing at least 10-15% of your salary to your 401k each year. However, the amount you should contribute depends on your retirement goals and financial situation.

Q: How do I calculate my 401k percentage?

A: To calculate your 401k percentage, divide the amount you contribute to your 401k by your annual salary.

Q: What factors affect my 401k percentage?

A: Your retirement goals and timeline, current salary, expected retirement expenses, 401k plan, employer’s matching policy, and other retirement savings accounts can all affect your 401k percentage.

Q: How can I maximize my 401k contributions?

A: You can maximize your 401k contributions by contributing the maximum amount allowed by the IRS each year, taking advantage of your employer’s matching contributions, considering catch-up contributions if you’re over 50 years old, and adjusting your contribution rate each year based on your financial situation and retirement goals.

Conclusion of How to Calculate Percentage 401k

Calculating your 401k percentage is a vital part of retirement planning. By understanding how much you should be contributing and how to calculate your contribution rate, you can adjust your saving and spending habits to meet your retirement goals. Remember to consider all the factors that affect your 401k percentage and use strategies to maximize your contributions. With proper planning and knowledge, you can ensure a comfortable and secure retirement.

Gallery

What Percentage Of 401k Should I Contribute – 401kInfoClub.com

Photo Credit by: bing.com /

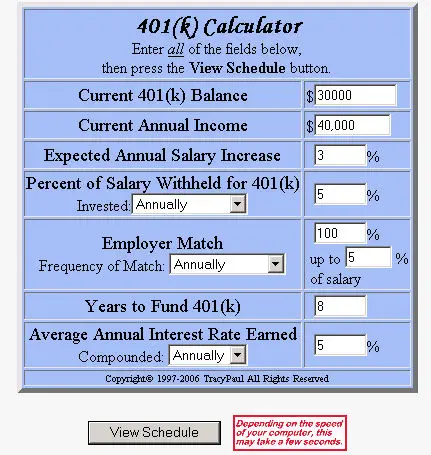

A 401k Calculator That Will Make You Rich

Photo Credit by: bing.com / 401k calculator example rich

Free 401k Retirement Calculators | Research401k

Photo Credit by: bing.com / 401k calculators

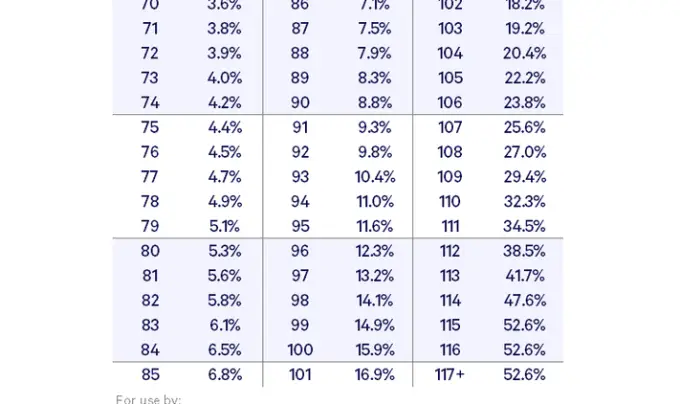

How To Calculate 401k Minimum Distribution – 401kInfoClub.com

Photo Credit by: bing.com /

How Much Should I Have In My 401k At 50? – Financial Samurai

Photo Credit by: bing.com / 401k financialsamurai