Are you trying to calculate the percentage APR for a loan or credit card but not sure where to start? Understanding how to calculate percentage APR can be confusing and overwhelming, but it’s an essential step to take before making any financial decisions. In this article, we’ll break down the process and simplify it for you, so you can make informed decisions with confidence.

Pain Points Related to How to Calculate Percentage APR

When it comes to calculating percentage APR, there may be several obstacles that make it challenging for people. One of the most common issues is a lack of understanding of what APR is and how it’s different from the interest rate. Another challenge is that many lenders use different formulas to calculate their APR, making it difficult to compare offers from different lenders.

Answering the Target of How to Calculate Percentage APR

To calculate percentage APR, you need to take into account several factors, including the loan amount, the interest rate, the length of the loan, and any fees or charges that the lender may impose. The formula for calculating APR is as follows:

APR = [(Total Interest/Loan Amount) / Number of Days in Loan Term] x 365 x 100

Once you have calculated the APR, you can use it to compare loan offers from different lenders and determine which one offers the best deal. Keep in mind that APR is an annual rate, so it may not be accurate for short-term loans or credit cards with promotional rates.

Summary of Main Points

Understanding how to calculate percentage APR is crucial for anyone considering a loan or credit card. It’s essential to differentiate between APR and interest rates, as they are not the same. APR takes into account additional costs associated with the loan, making it a more accurate representation of the overall cost of borrowing. By using the right formula, you can easily calculate APR, allowing you to make informed financial decisions.

Explaining the Target of How to Calculate Percentage APR

Imagine you are shopping for a car loan or a credit card. Each lender offers you seemingly attractive interest rates, but to get a clearer picture of the total cost of borrowing, you need to calculate the APR. The APR takes into account all the other costs associated with borrowing, such as fees, and is presented as a percentage, allowing you to compare loans or credit cards from different lenders.

Factors Impacting APR

Several factors can impact the APR of a loan or credit card. These include the borrower’s credit score, the length of the loan, the type of loan, and any fees associated with it. A borrower with a higher credit score may be eligible for a lower APR, while longer-term loans may have a higher APR because of the increased risk involved for the lender.

:max_bytes(150000):strip_icc()/Clipboard01-5c525fc14cedfd0001f91622.jpg)

Finding the Best APR

To find the best APR, it’s essential to comparison shop and check offers from multiple lenders. Make sure to review the terms and conditions of each loan or credit card to ensure you fully understand the costs involved. Don’t forget to factor in any fees or charges, such as origination fees or late payment fees when calculating the APR.

Common Mistakes to Avoid

When calculating the APR, it’s important to make sure you’re using the right formula and are factoring in all the relevant costs involved. One of the most common mistakes people make is not factoring in fees or charges, leading to an inaccurate APR calculation. Additionally, be wary of lenders that use vague or confusing language when discussing APR or try to push you towards loans with higher APRs.

Question and Answer Section

Q: What is the difference between interest rate and APR?

A: The interest rate is the annual cost of borrowing, expressed as a percentage of the loan amount. APR, on the other hand, includes all the costs associated with borrowing, including fees and charges, to provide a more accurate representation of the overall cost of borrowing.

Q: Can the APR change over time?

A: Yes, the APR can change over time, particularly for variable interest rate loans or credit cards. Make sure to check the terms and conditions of each loan or credit card to understand how the APR may change over time.

Q: How does my credit score impact the APR?

A: Borrowers with higher credit scores may be eligible for lower APRs, as they are considered less risky borrowers. Conversely, borrowers with lower credit scores may be charged higher APRs to compensate for the increased risk involved for the lender.

Q: Can I negotiate the APR with a lender?

A: In some cases, you may be able to negotiate the APR with a lender, particularly if you have excellent credit or have a long-standing relationship with the lender. However, not all lenders are willing to negotiate APRs, so it’s important to shop around and compare offers from different lenders.

Conclusion of How to Calculate Percentage APR

Knowing how to calculate percentage APR is a crucial step in understanding the total cost of borrowing for loans or credit cards. By understanding the difference between APR and interest rates, you can make informed financial decisions and avoid falling into debt traps. Remember to factor in all costs associated with a loan and to shop around to find the best loan or credit card that meets your needs.

Gallery

Annual Percentage Rate: What Is APR? – ZING Blog By Quicken Loans

Photo Credit by: bing.com / loan calculation calculating

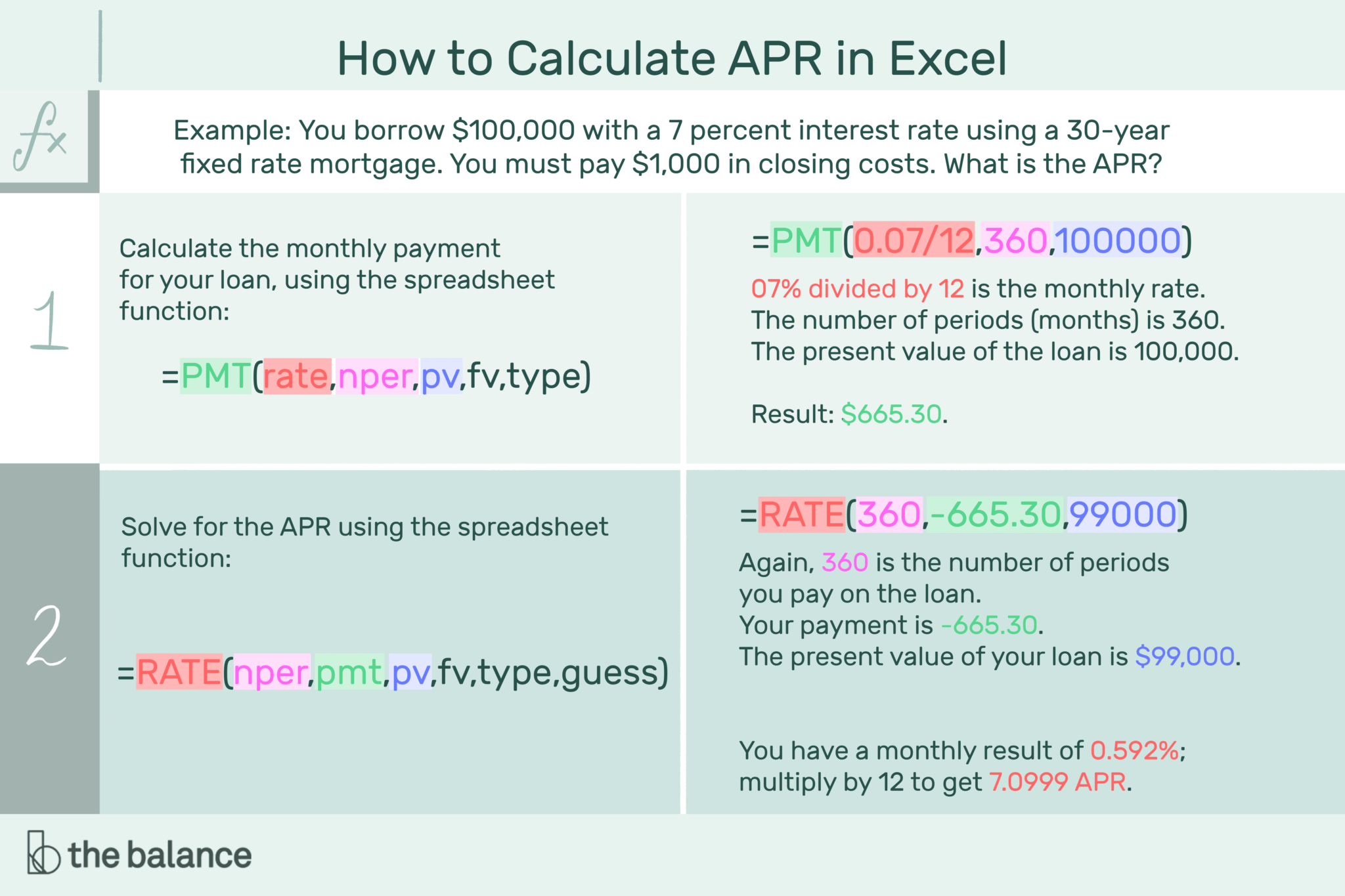

How To Calculate Annual Percentage Rate (Apr) Intended For Credit Card

Photo Credit by: bing.com / spreadsheet

Annual Percentage Rate (APR) Definition

:max_bytes(150000):strip_icc()/Clipboard01-5c525fc14cedfd0001f91622.jpg)

Photo Credit by: bing.com / percentage investopedia loans

What Is APR? Mortgage APR? | MLS Mortgage

Photo Credit by: bing.com / apr calculate mortgage rate formula loan calculating percentage annual finance known calculated

How To Calculate Annual Percentage Rate: 12 Steps (with Pictures)

Photo Credit by: bing.com / percentage rate annual calculate apr charge finance