Are you curious about how to calculate percentage APY? Understanding annual percentage yield can be confusing, but it’s an essential concept to understand if you want to make informed decisions about your investments. In this post, we’ll explain what APY means and how to calculate it, so you can make smart investment choices.

When it comes to investments, the goal is to earn as much interest as possible. However, comparing different investment options can be tricky, especially when they have different interest rates and compounding schedules. That’s where annual percentage yield comes in. By calculating APY, you can compare different investment options and understand exactly how much interest you’ll earn over time.

So, what is APY, and how do you calculate it? APY represents the total amount of interest you’ll earn on an investment over one year, expressed as a percentage of the initial deposit. To calculate APY, you’ll need to know the interest rate, the compounding frequency, and the length of the investment term.

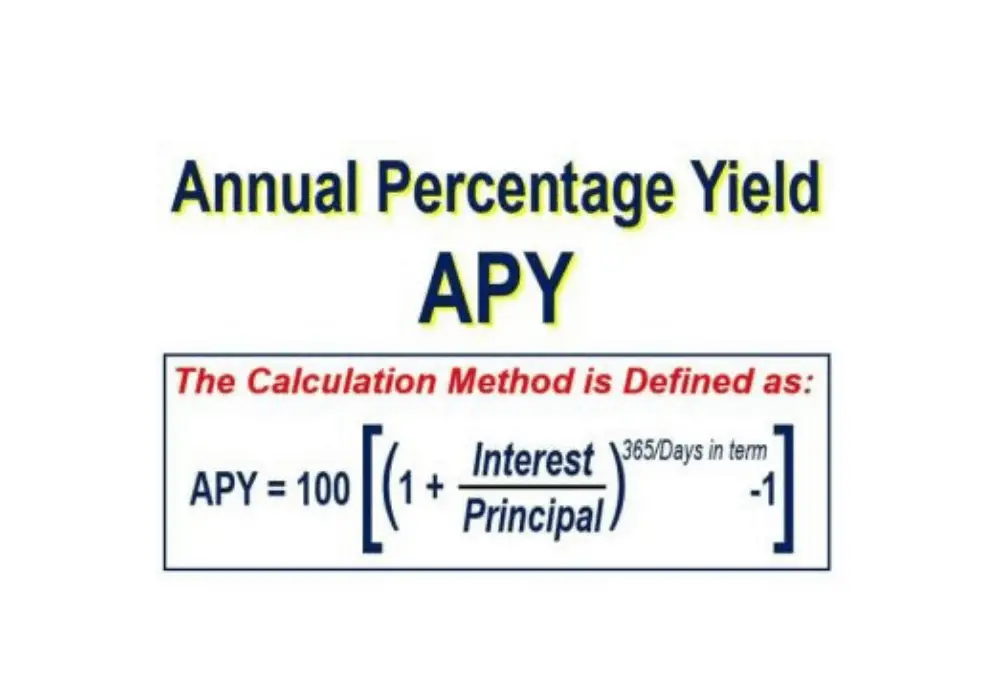

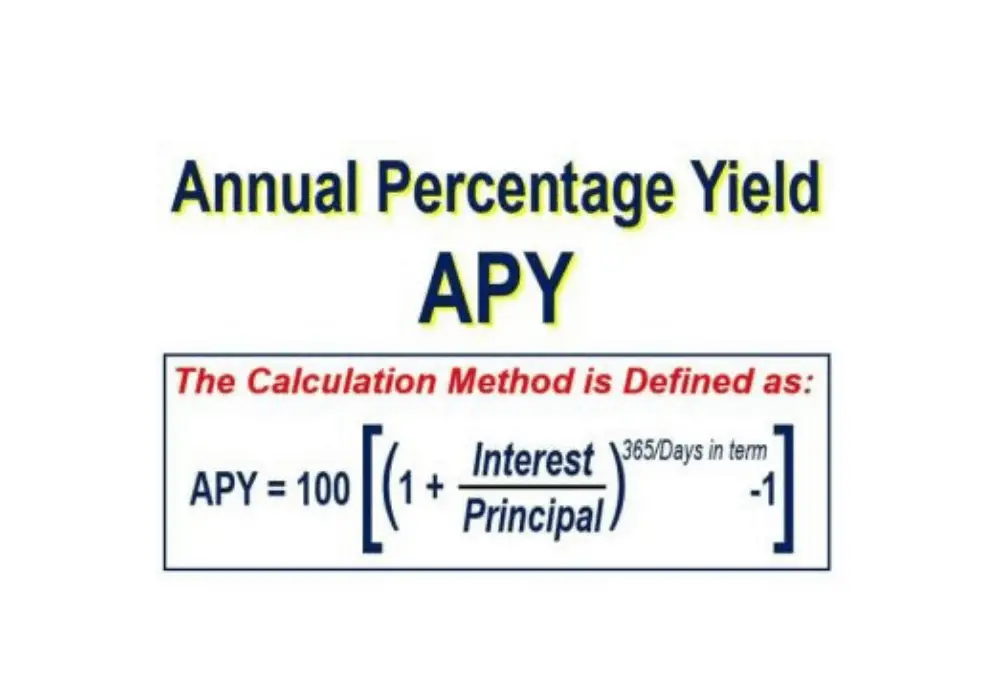

To calculate APY, use the following formula:

APY Formula:

In this formula, “r” represents the interest rate, “n” represents the number of compounding periods per year, and “t” represents the length of the investment term in years.

Let’s look at an example to make this formula more concrete. Suppose you deposit $1,000 in a savings account that earns an annual interest rate of 3.5%, compounded monthly. If you leave your money in the account for three years, what will your APY be?

Using the APY formula, we can calculate:

APY Calculation:

Based on this calculation, your APY would be 3.54%. This means that over a three-year period, you would earn $107.16 in interest on your $1,000 deposit.

In summary, calculating APY is a critical step in comparing different investment options and understanding exactly how much interest you’ll earn over time. By using the APY formula, you can make informed decisions about your investments and maximize your returns.

Why is APY Important?

APY is a crucial concept to understand because it allows you to compare different investment options objectively. When you’re comparing interest rates or investment returns, you need to consider how often interest is compounded. APY accounts for the compounding frequency, so you can compare apples to apples.

For example, suppose you’re trying to decide between two savings accounts. One account earns a high-interest rate of 5%, but the interest is compounded annually. The other account earns a lower interest rate of 4.5%, but the interest is compounded monthly. Without considering APY, you might assume that the first account is the better option. However, when you calculate APY, you’ll find that the second account actually has a higher APY and will earn you more money in the long run.

Compounding Frequency

As mentioned earlier, the compounding frequency is an important factor in calculating APY. Compounding refers to the process of earning interest on your interest. The more frequently interest is compounded, the faster your balance will grow.

Common compounding frequencies include daily, weekly, monthly, quarterly, semi-annually, and annually. When you’re choosing an investment option, consider the compounding frequency and how it will impact your APY and total return.

What to Consider When Calculating APY

When calculating APY, there are a few things to keep in mind. First, make sure you’re using the correct interest rate and compounding frequency. Check the terms of your investment and use the most up-to-date information available. Additionally, remember that APY is an estimate based on certain assumptions. Actual returns may vary depending on market conditions and other factors.

Conclusion of How to Calculate Percentage APY

Calculating APY is an essential skill for making informed investment decisions. By using the APY formula, you can compare different investment options and understand exactly how much interest you’ll earn over time. Remember to consider the compounding frequency and other factors when choosing an investment option, and always use the most up-to-date information available. With these tips in mind, you’ll be well on your way to maximizing your investment returns.

Question and Answer

What is the difference between APY and APR?

APY and APR both represent interest rates, but they are calculated differently. APR, or annual percentage rate, represents the annual cost of borrowing money, expressed as a percentage of the loan amount. It does not take into account compounding. APY, on the other hand, represents the total amount of interest you’ll earn on an investment over one year, taking into account compounding. APY is used to compare investment returns, while APR is used to compare borrowing costs.

How often should I check my APY?

It’s a good idea to check your APY periodically to ensure that you’re earning the best possible return on your investment. However, how often you check will depend on your investment goals and the type of investment. Some investments, such as certificates of deposit, have fixed interest rates and terms, so there is no need to check your APY frequently. Other investments, such as high-yield savings accounts or money market accounts, may have variable interest rates that change frequently. In these cases, checking your APY regularly can help you make informed decisions about your investments.

Can APY be negative?

No, APY cannot be negative. APY represents the total amount of interest you’ll earn on an investment over one year, expressed as a percentage of the initial deposit. Even if the interest rate is negative, the compounding factor will ensure that the APY is not negative.

Does APY take into account taxes?

No, APY does not take taxes into account. When you earn interest on an investment, you will typically owe taxes on that interest income. The actual amount of money you earn after taxes will be less than your APY. However, calculating your APY can help you compare investment options and understand how much interest you’ll earn before taxes.

Gallery

How To Calculate Interest Yield – Haiper

Photo Credit by: bing.com /

Calculate Apy Formula – IfanSidharth

Photo Credit by: bing.com /

Annual Percentage Yield (APY) – Definition And Meaning – Market

Photo Credit by: bing.com / apy yield calculating earned definition investor

How To Calculate Interest Earned From Apy – Career Options In Marketing

Photo Credit by: bing.com / apy earned netbank deposits

APY Calculator – Calculate Annual Percentage Yield For A Deposit – Top

Photo Credit by: bing.com / apy