Are you trying to figure out how to calculate percentage bank interest but don’t know where to start? Look no further! Understanding how to calculate interest rates is an essential skill that can benefit you in countless ways. Whether you’re taking out a loan or opening a savings account, knowing how to calculate interest rates can help you make informed financial decisions and save money in the long run.

When it comes to figuring out how to calculate percentage bank interest, there are a few pain points to consider. For one, interest rates can be confusing and difficult to understand, especially if you’re not familiar with financial terminology. Additionally, different types of accounts and loans may have varying interest rates, making it hard to keep track of how much you owe or how much you’re earning.

The actual process of calculating bank interest, however, is relatively straightforward. To find out how much interest you owe or how much you’re earning, you’ll need to use a simple interest formula. This involves multiplying your principal amount (the amount of money you borrowed or invested) by your interest rate and the amount of time (in years) that you’re being charged interest.

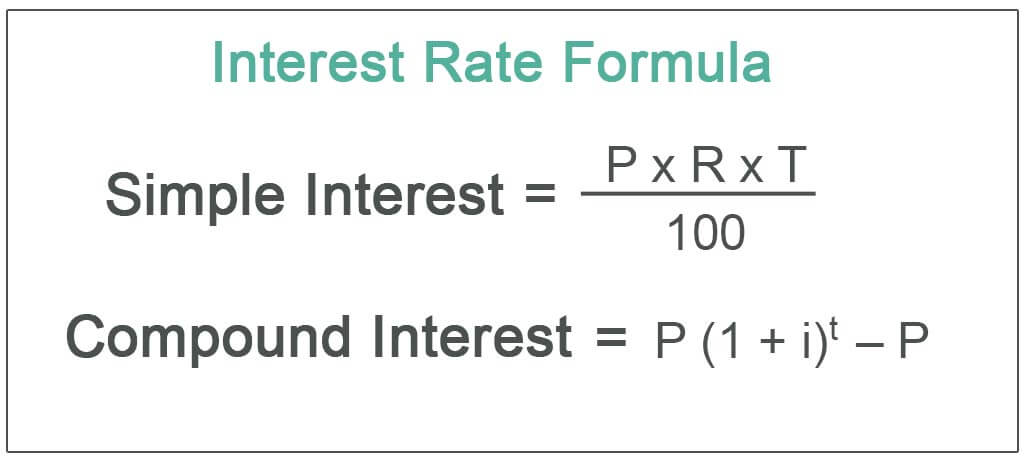

To break it down further, the formula for calculating simple interest is:

Simple Interest = (P x R x T)/100

Where:

P = Principal amount

R = Rate of interest

T = Time (in years)

Overall, understanding how to calculate percentage bank interest comes down to a basic understanding of mathematical formulas and financial terminology. By taking the time to learn these concepts, you can make more informed financial decisions and achieve your financial goals with confidence.

How to Calculate Percentage Bank Interest: A Personal Experience

When I was first learning how to calculate bank interest, I found the process daunting and confusing. But once I broke it down into smaller steps and took the time to understand the terminology and formulas, it became much more manageable. For example, I found that breaking down the formula into individual variables (like P, R, and T) made it easier to remember and apply in real-life situations.

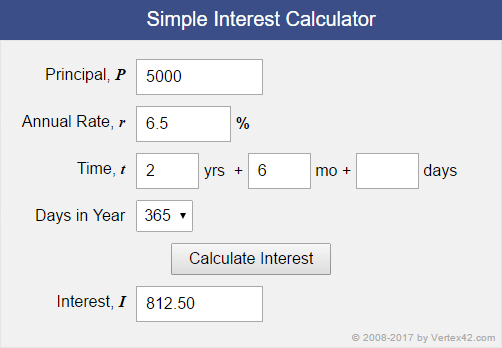

One tip that helped me was to use online calculators to double-check my work and ensure that I was getting accurate results. Additionally, I made it a point to regularly monitor my account balances and interest rates to avoid any surprises or discrepancies.

Different Types of Interest Rates

When it comes to understanding how to calculate bank interest, it’s important to keep in mind that not all interest rates are created equal. For example, there are different types of interest rates that may apply depending on your account or loan.

One type of interest rate is a fixed interest rate, which remains the same over the entire life of the loan or investment. This can provide predictable payments or earnings, but may not reflect changes in the overall economy or interest rate market.

Another type of interest rate is a variable interest rate, which fluctuates over time based on changes in the market or other factors. While this can provide opportunities for higher earnings or savings, it can also lead to uncertainty or unexpected changes in payments or earnings.

Calculating Compound Interest

Another important concept when it comes to how to calculate percentage bank interest is compound interest. This is interest that is calculated not only on the principal amount, but also on any accumulated interest from previous periods.

To calculate compound interest, you will need to use a slightly different formula:

Compound Interest = P (1 + R/n)^(nt) – P

Where:

P = Principal amount

R = Annual interest rate

n = Number of times compounding occurs each year

t = Time (in years)

Overall, understanding how to calculate compound interest can help you make smart financial decisions and maximize your earnings or savings over time.

The Benefits of Knowing How to Calculate Bank Interest

Now that you understand the basics of how to calculate percentage bank interest, you can enjoy a variety of benefits. For one, you’ll be better equipped to make informed financial decisions and avoid costly mistakes or surprises. Additionally, you’ll be able to track your savings or loan balance more accurately and adjust your strategies as needed. Overall, knowing how to calculate bank interest is an essential skill that can improve your financial literacy and help you achieve your financial goals in the long run.

Question and Answer Section

Q: How do I find my interest rate?

A: Your interest rate can typically be found on your account statement or loan paperwork. If you’re unsure about your interest rate, you can contact your bank or lender directly for more information.

Q: What is the difference between simple interest and compound interest?

A: Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal amount plus any accumulated interest from previous periods. This means that compound interest can result in higher earnings or payments over time.

Q: Can interest rates change over time?

A: Yes, interest rates can fluctuate based on changes in the market, the economy, or other factors. This is why it’s important to regularly monitor your account or loan balance and adjust your strategies as needed.

Q: When should I use a fixed interest rate versus a variable interest rate?

A: The type of interest rate you choose will depend on your individual financial goals and circumstances. A fixed interest rate can provide predictable payments or earnings, while a variable interest rate can provide opportunities for higher earnings or savings. It’s important to consider your personal risk tolerance and financial situation when making this decision.

Conclusion of How to Calculate Percentage Bank Interest

Understanding how to calculate percentage bank interest is an essential skill that can benefit you in countless ways. By taking the time to learn the basics of financial terminology and formulas, you can make informed financial decisions, avoid costly mistakes, and achieve your financial goals with confidence. Whether you’re opening a savings account, taking out a loan, or planning your retirement, knowing how to calculate interest rates is a valuable tool that can help you succeed.

Gallery

Total Interest Percentage Outlet Discount, Save 63% | Jlcatj.gob.mx

Photo Credit by: bing.com /

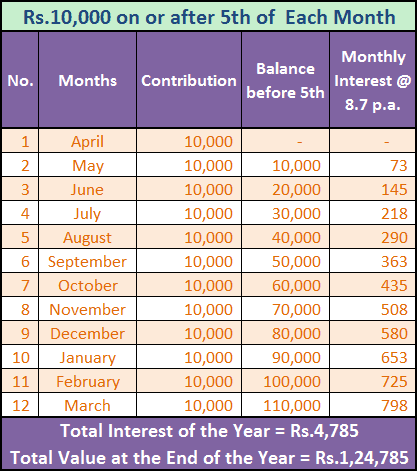

How Bank Calculate Interest?

Photo Credit by: bing.com / interest bank calculation calculate ppf amount month banks substantial difference there so

How To Calculate Interest Rate: 10 Steps (with Pictures) – WikiHow

Photo Credit by: bing.com / interesse calculating tasso suku menghitung calcolare

House Loan Limit Calculator – Home Sweet Home | Insurance – Accident

Photo Credit by: bing.com / calculator loan interest simple formula house prt limit

Tính Lãi Tiết Kiệm Ngân Hàng – WikiHow

Photo Credit by: bing.com /