Are you struggling with calculating percentage deductions? Do you find yourself confused when trying to determine the percentage reduction of a value?

Many people find it difficult to calculate percentage deductions, whether they are trying to determine the discount on a sale item, calculate the amount of tax deducted from their paycheck, or figure out the decrease in their investment portfolio. It can be frustrating not to know how to do the math and calculate accurate percentages.

So, how do you calculate percentage deductions?

To calculate percentage deductions, you need to know the original value and the percentage to be deducted. First, divide the percentage by 100 to get the decimal form of the percentage. Next, multiply the decimal form by the original value. The result is the amount of deduction.

In summary, to calculate percentage deductions:

- Divide the percentage by 100 to get the decimal form

- Multiply the decimal form by the original value

- The result is the amount of deduction

Understanding the Target of How to Calculate Percentage Deduction

Let me share with you my personal experience of calculating percentage deductions. I was shopping for a new car, and I found one that was perfect for me, but it was listed with a discount of 20%. I thought to myself, what a great deal! But, I wasn’t sure how much the deduction would be.

After consulting with the sales representative, I learned that the original price of the car was $25,000. To calculate the discount, I divided 20 by 100, which gave me 0.20 as the decimal form of the percentage. Then, I multiplied 0.20 by $25,000, which gave me $5,000 as the discount amount. So, the final price for the car was $20,000.

The Importance of Percentage Deductions in Financial Planning

Knowing how to calculate percentage deductions is crucial when it comes to financial planning, whether you are calculating taxes, discounts, or returns on investment. It allows you to make informed decisions about your finances and helps you to avoid being misled by advertisements that might contain discounts or deals with hidden fees.

Examples of How to Calculate Percentage Deduction

One example of how to calculate percentage deduction could be found in calculating tax deductions from your paycheck. To determine the amount of tax deducted from your paycheck, you need to know your gross income, your tax bracket, and your deductions. By subtracting your deductions from your gross income, you can determine your taxable income. Then, you can multiply your taxable income by your tax rate, the percentage of income that you owe in taxes. The final result is the amount of tax deduction from your paycheck.

Further Explanation of How to Calculate Percentage Deduction

Another example of how to calculate percentage deduction could be found in measuring the decrease in your investment portfolio. If your investment portfolio has decreased by 10%, for instance, you need to know the original value of your investment to calculate the percentage decrease. By dividing the decrease percentage by 100 and then subtracting the decimal form from 1, you can determine the percentage of the remaining value. Then, you can multiply the remaining value by the percentage of the remaining value to get the actual decrease in your investment portfolio.

Frequently Asked Questions about How to Calculate Percentage Deduction

Q: Can percentage deductions be negative?

A: No, percentage deductions cannot be negative. They represent the reduction of a value, not an increase.

Q: How do I calculate the percentage of a value?

A: To calculate the percentage of a value, you need to multiply the value by the percentage and then divide by 100.

Q: Is it possible to have a percentage deduction above 100%?

A: No, a percentage deduction cannot be above 100%, as it would mean that the value has been reduced by more than its original value.

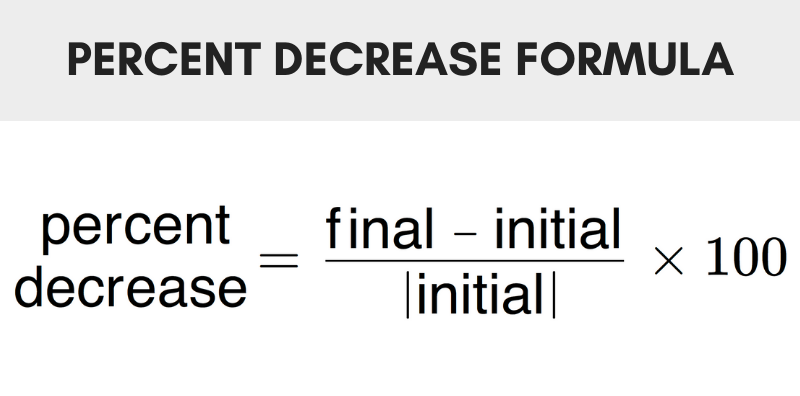

Q: How do I calculate the percentage change between two values?

A: To calculate the percentage change between two values, you need to subtract the initial value from the final value, divide the result by the initial value, and then multiply by 100.

Conclusion of How to Calculate Percentage Deduction

Knowing how to calculate percentage deductions is an essential skill that can help you make informed decisions about your finances. By understanding the formulas for calculating percentage deductions, you can avoid being misled by discounts, taxes, or returns on investment that might be less advantageous than they seem at first glance.

Gallery

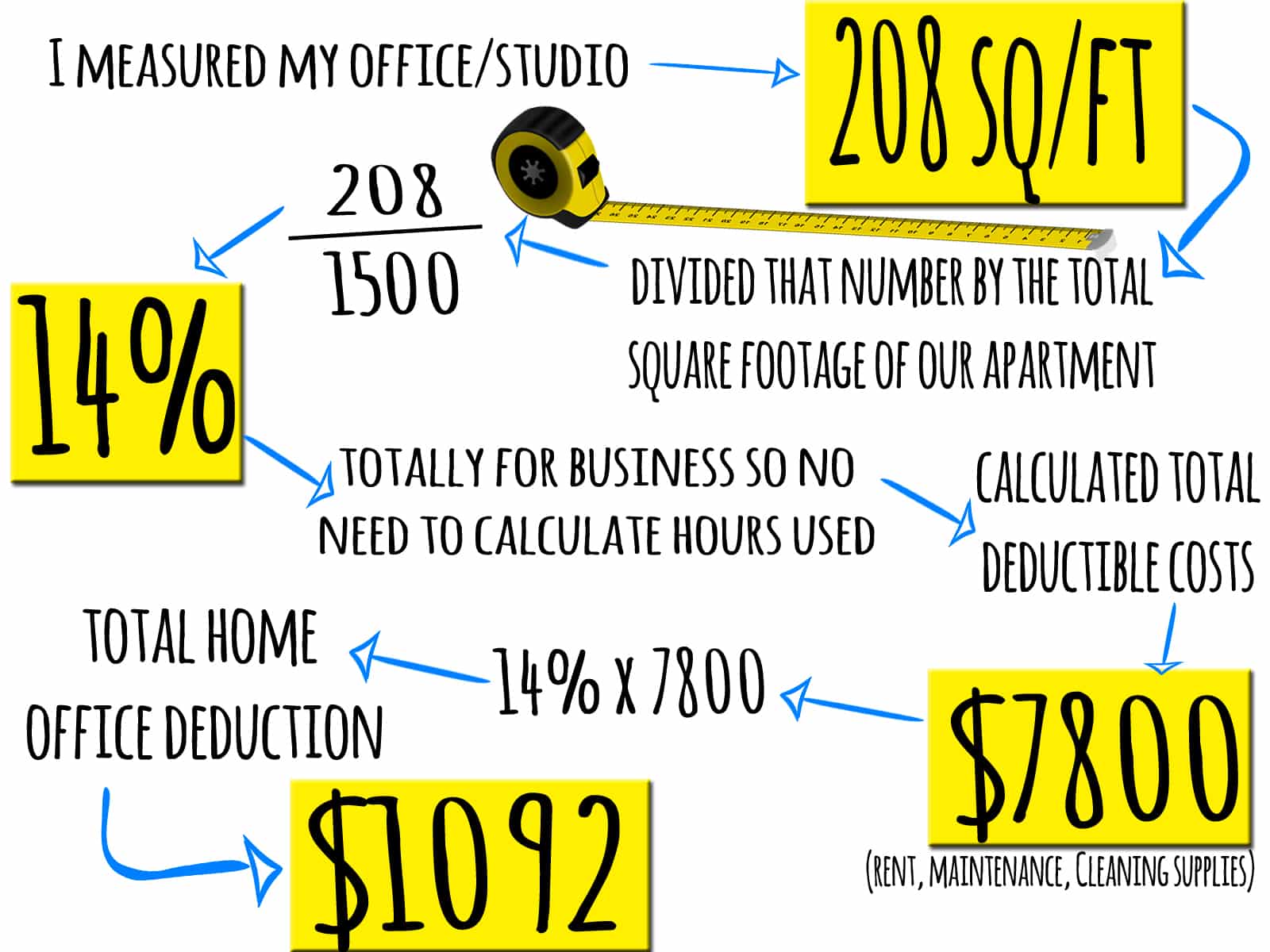

Freelancer Taxes: How To Deduct Your Home Office – Rags To Reasonable

Photo Credit by: bing.com / office deduction taxes freelancer deduct perk

Percent Decrease Calculator – Find Percentage Decrease – Inch Calculator

Photo Credit by: bing.com /

How To Calculate Percentage Change Excel – Haiper

Photo Credit by: bing.com /

How To Calculate Deductions Under Section 16 With Examples | The Blog

Photo Credit by: bing.com / pajak rebate penghasilan objek incometax understanding deductions calculate taxpayers policies irb compliance accountants gpg pendapatan pemerintah teletype officenewz ajaib calculating

Calculate Tax Deduction On Salary – TAXW

Photo Credit by: bing.com / deduction percentage salaries careers calculate math