Are you an investor who wants to know how to calculate percentage for stocks? Understanding how to calculate percentage for stocks is essential to making informed investment decisions. With the right tools and knowledge, you’ll be able to analyze the performance of stocks and determine the best investment opportunities.

Investing in the stock market can be a daunting task, especially for beginners. One challenge is learning how to calculate percentage for stocks, which can reveal the rate of return on your investments over a certain period. A lack of understanding of these calculations can result in poor investment choices that may lead to significant losses.

The answer to how to calculate percentage for stocks is relatively simple. First, identify the starting stock price, then identify the ending price. Subtract the starting price from the ending price, and divide the result by the starting price. Finally, multiply the result by 100, and you have the percentage return for your investment.

In summary, to calculate the percentage increase or decrease in a stock’s price, subtract the starting price from the ending price, divide the result by the starting price, and multiply the result by 100. This simple formula will give you the percentage return of your investment.

Understanding Compound Interest

The concept of compound interest is essential to understanding how to calculate percentage for stocks. Compound interest occurs when investors earn interest on both their original investment and any accumulated interest. In other words, interest is earned on interest. This compounding effect can significantly increase the rate of return on your investments over several years.

As an example, suppose you invest $1,000 in a stock and earn a 10% annual return. After one year, your investment would be worth $1,100. If you left the money in the investment for another year, you would earn 10% on $1,100, bringing your investment value to $1,210. The compounding effect will continue to add interest to your investment, resulting in a higher rate of return over time.

Diversification and Risks

One key strategy for successful investing is diversification. This involves spreading your investments across different stocks, sectors, and asset classes to minimize your risks. Diversification protects your investments from significant losses if one sector of the market experiences a downturn, reducing the overall impact on your portfolio.

Investing in the stock market involves risks, and you should have a clear understanding of those risks before investing. While diversification can reduce your risks, there are no guarantees in the stock market. Prices can fluctuate, and your investments may lose value, particularly in volatile markets. It’s essential to monitor your investments regularly to ensure you’re making informed decisions that fit your goals and risk profile.

Tracking Performance

Another critical aspect of successful investing is tracking the performance of your investments. Knowing how to calculate percentage for stocks is one tool for monitoring your portfolio’s performance. By tracking changes in stock prices and calculating your percentage returns, you can identify patterns and trends that can inform your investment decisions.

Many online tools and resources are available to help you track your investments and monitor performance. Some of these include brokerage platforms, investment apps, and financial news websites. By leveraging these resources, you can stay informed and make data-driven decisions to maximize your investment returns.

Question and Answer

Here are some common questions about how to calculate percentage for stocks:

1. How do I calculate my percentage return for a stock?

Identify the starting stock price, identify the ending price, subtract the starting price from the ending price, divide the result by the starting price, and multiply the result by 100 to get the percentage return.

2. How important is diversification?

Diversification is an essential strategy for reducing your investment risks. By spreading your investments across different sectors and stocks, you can minimize the impact of a market downturn on your portfolio

3. What are the risks of investing in the stock market?

Investing in the stock market involves risks, including the possibility of losing money if your investments decline. Market volatility, economic changes and other factors can impact the value of your investments.

4. What tools can I use to track my investments?

Many online resources are available for tracking investment performance. You can use brokerage platforms, investment apps, and financial news websites to monitor stock prices and stay informed about trends and patterns in the market.

Conclusion of how to calculate percentage for stocks

Knowing how to calculate percentage for stocks is an essential skill for investors. By understanding the process for calculating percentage returns, you can make informed decisions about your portfolio and monitor the performance of your investments. Remember to diversify your portfolio, understand the risks of investing in the stock market, and use online tools and resources to track your investments regularly. With these tools and knowledge, you can invest with confidence and maximize your returns.

Gallery

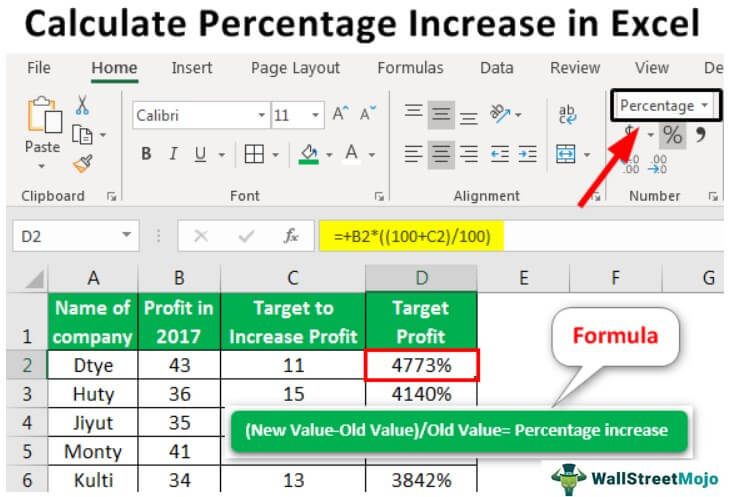

How To Calculate Percentage Increase In Excel? | Step By Step Guide

Photo Credit by: bing.com / percentage increase

How To Calculate Percentage: Solve Through Percentage Formula

Photo Credit by: bing.com / percentage calculate formula solve through

Calculate Percentage Increase Between 3 Numbers In Excel [Free Template]

![Calculate Percentage Increase between 3 Numbers in Excel [Free Template]](https://www.exceldemy.com/wp-content/uploads/2021/06/percentage-increase-or-decrease.jpg)

Photo Credit by: bing.com / calculate percent depicts exceldemy

Percentage Calculator Free Tool – Check Percentage From Any Number

Photo Credit by: bing.com /

How To Calculate Percentage With The Easiest Percentage Formula

Photo Credit by: bing.com / calculate formula representation graphical easiest