If you’re new to investing, calculating percentage gain can be a daunting task. You want to know how much you’ve made or lost, but the calculation can be complicated, and mistakes can be costly. In this article, we’ll break down the steps to calculate percentage gain, making it easier for you to track your investments.

When it comes to investing, one of the most significant challenges is figuring out how much you’ve made (or lost). Calculating percentage gain is especially important because it tells you how well your investment is doing. Many people find it challenging to calculate percentage gain because it requires an understanding of math and several steps.

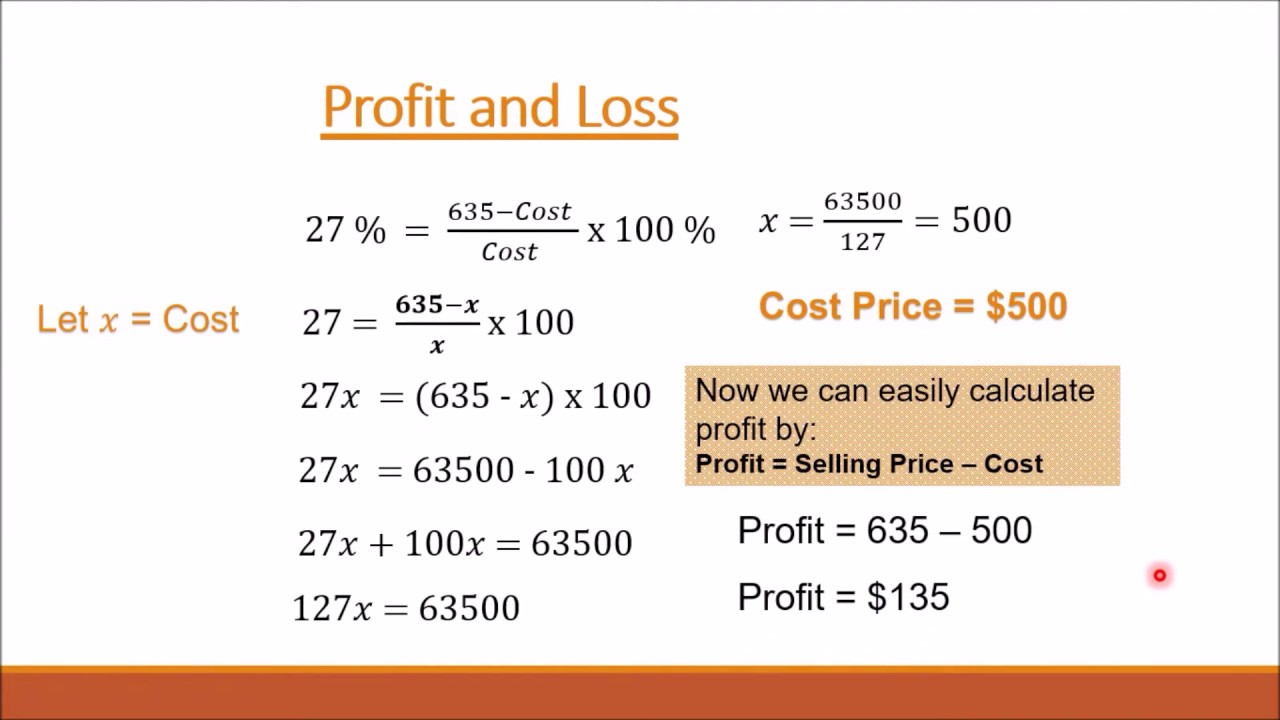

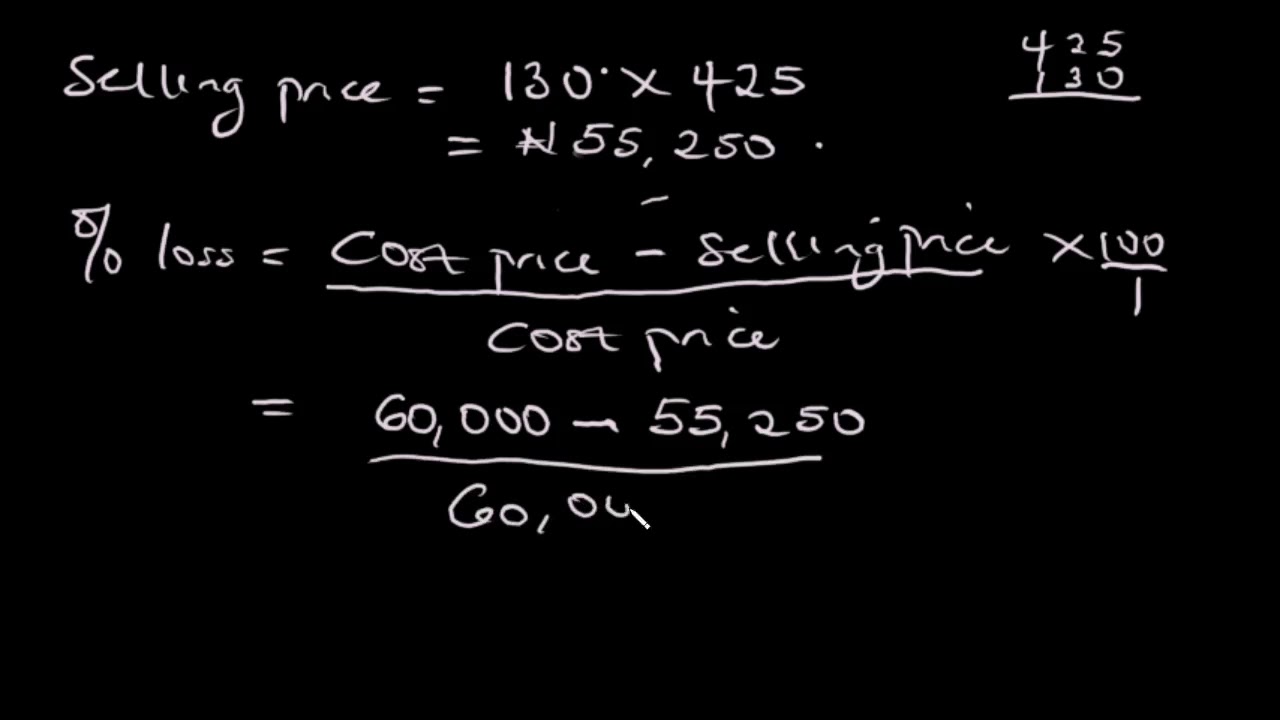

Calculating percentage gain is simply the difference between the selling price and the buying price, divided by the buying price, and then multiplied by 100. The formula looks like this:

Percentage Gain = ((Selling Price – Buying Price) / Buying Price) x 100

The first step is to locate the buying and selling prices. These are the prices that you paid for the investment and the price that you sold it for or the current market price if you haven’t sold it, respectively. Next, you’ll take the selling price and subtract the buying price. Then, you’ll divide that number by the buying price. Finally, you’ll multiply that number by 100, and that will give you the percentage gain.

Now that you know how to calculate percentage gain, let’s summarize the main points:

- Calculating percentage gain is important to track your investment’s performance.

- The formula for calculating percentage gain is ((Selling Price – Buying Price) / Buying Price) x 100.

Calculating Percentage Gain: A Personal Experience

When I first started investing, I had no idea how to calculate percentage gain. I remember feeling overwhelmed every time I had to figure out if I was making a profit or a loss. But once I learned the formula and started using it regularly, it became second nature. Now, I can quickly calculate percentage gain in my head and feel confident in my investments.

When calculating percentage gain, it’s essential to keep track of your buying and selling prices to make the calculation simpler. Don’t forget that percentage gain can be negative if you sell your investment for less than you bought it for.

The Importance of Tracking Percentage Gain

Tracking your percentage gain is crucial for several reasons. Firstly, it lets you know how your investments are performing. If you see a high percentage gain, you know that your investment is doing well. Secondly, knowing your percentage gain can help you make better investment decisions. If you see that an investment’s percentage gain is consistently low, you may want to consider selling it and investing elsewhere.

To calculate percentage gain, follow the formula ((Selling Price – Buying Price) / Buying Price) x 100. Knowing how to calculate percentage gain is essential for tracking your investments and making informed investment decisions.

Calculating Percentage Gain vs. Percentage Change

It’s essential to distinguish between percentage gain and percentage change. Percentage gain refers specifically to the gain made on an investment, while percentage change can refer to any change in percentage (e.g., an increase in temperature). When calculating percentage gain, you’re looking at the difference between the buying and selling prices, whereas percentage change refers to any percentage difference.

The Impact of Fees on Percentage Gain

Fees can have a significant impact on your percentage gain. When calculating your percentage gain, it’s essential to consider any fees associated with buying or selling your investment. For example, if you buy an investment for $100 and pay a $10 fee, your total investment cost is now $110. Suppose you sell that investment for $120 and pay another $10 fee. In that case, your total selling price is $110, meaning that you only made a $10 profit. Without factoring in the fees, you might calculate your percentage gain at 20%, but in reality, it’s only about 9%.

Calculating Percentage Gain: Tips and Tricks

When calculating percentage gain, keep these tips and tricks in mind:

- Remember the formula: ((Selling Price – Buying Price) / Buying Price) x 100

- Keep track of your buying and selling prices, including any associated fees.

- Don’t forget that percentage gain can be negative, indicating a loss.

- Use a percentage gain calculator to simplify the process.

Question and Answer

Q: Can percentage gain be negative?

A: Yes, percentage gain can be negative, indicating a loss.

Q: Do fees impact percentage gain?

A: Yes, fees can have a significant impact on your percentage gain.

Q: Is there an easier way to calculate percentage gain?

A: Yes, you can use a percentage gain calculator to simplify the process.

Q: Why is it essential to track percentage gain?

A: Tracking percentage gain is crucial for monitoring your investments’ performance and making informed investment decisions.

Conclusion of How to Calculate Percentage Gain

Calculating percentage gain is essential for tracking your investment’s performance and making informed investment decisions. To calculate percentage gain, you need to know the buying and selling prices and remember the formula ((Selling Price – Buying Price) / Buying Price) x 100. Don’t forget to consider any associated fees when calculating your percentage gain. By keeping track of your percentage gain, you can better understand how well your investments are performing, and when to buy or sell.

Gallery

How To Calculate Percentage Increase And Decrease – How To Wiki 89

Photo Credit by: bing.com / percent percentages impressions igcse number mathematics thames

How To Calculate Percentage Gain/loss – Haiper

Photo Credit by: bing.com /

Equation For Calculating Percentage Loss In Mass – Tessshebaylo

Photo Credit by: bing.com / percentage calculating calculator

Gain Formula | How To Calculate Gains? (Step By Step Examples)

Photo Credit by: bing.com / gains

Calculating Investment Percentage Gains Or Losses

/thinkstockphotos458416487-5bfc2b63c9e77c005143e99c.jpg)

Photo Credit by: bing.com / calculate