Have you ever struggled with calculating GST and wondered what percentage you should apply? If so, you’re not alone. Many people find it challenging to calculate the GST percentage correctly. But don’t worry, in this article, we’ll show you how to calculate percentage gst quickly and efficiently.

Calculating the GST percentage can be a daunting task if you’re not familiar with how it works. It involves understanding the tax system and complying with the rules set by the government. Trying to do this when you’re not certain about it can lead to errors, costing money and time that could have been easily saved.

Calculating GST can be relatively simple. GST is calculated as a percentage of the price, and the percentage generally ranges from 5% to 18%. To calculate the GST on any given price, you have to multiply the price by the GST rate, expressed as a decimal.

Understanding how to calculate percentage gst is crucial for businesses and individuals all over the world. It allows you to stay compliant with the tax system and make faster and better financial decisions. Here are a few main points to keep in mind:

Understanding How to Calculate Percentage GST:

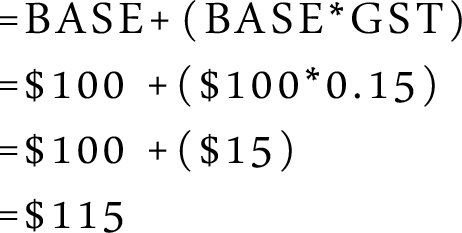

As mentioned earlier, you can calculate GST from any given price by multiplying the price by the GST rate. For example, let’s say you have a purchase worth $100. If the GST rate is 10%, then the calculation will be:$100 x 0.1 = $10. Therefore, the GST amount will be $10, and the total amount payable will be $100 + $10 = $110.

Another essential point to keep in mind is that the formula for calculating GST is universal, and you can use it for any amount or rate of GST:

The Formula:

GST = (Original Price x GST rate) / 100

or

GST = (Original Price * GST rate) ÷ 100

Using the formula mentioned above, you can calculate the GST with ease. Here’s a step-by-step guide:

Step 1:

Identify the original price of the goods or services you want to apply GST to.

Step 2:

Determine the GST rate that applies to the goods or services. This rate may be 5%, 10%, 12%, or 18% in most countries.

Step 3:

Multiply the original price of the goods or services by the GST rate in decimal form.

Step 4:

Divide the result from Step 3 by 100.

Example:

Let’s consider an example to make things clearer. Suppose you want to calculate the GST on a piece of furniture that costs $500. The GST rate is 10%. Here’s how you would calculate it:

GST = (500 x 10) / 100

GST = 50

Therefore, the GST amount would be $50, and the total amount payable would be $550 (original price + GST amount).

When to Calculate GST?

GST is usually calculated and charged on commercial transactions, such as sales or purchases between businesses. If you’re running a business, you need to register for GST if your annual turnover exceeds the threshold set by the government. In most countries, the threshold for registering for GST is around $75,000. If your business meets this criteria or is likely to, you should learn how to calculate percentage gst to ensure you comply with your local tax laws.

Frequently Asked Questions about How to Calculate Percentage GST

Q:What is GST?

A: GST stands for Goods and Services Tax. It’s a tax levied on most goods and services consumed in the country/region.

Q:What is the GST rate in my country/region?

A: The GST rate varies by country/region. For instance, it’s currently 10% in Australia, 7.5% in Canada, and 18% in India.

Q:Can I claim GST credits?

A: If you’re registered for GST, you can claim GST credits for any GST included in the price you pay for goods or services used in your business.

Q:Do I need to pay GST for goods and services purchased from overseas?

A: In most cases, you don’t need to pay GST on goods and services purchased from overseas unless they cost more than a certain threshold. However, you need to check your local tax laws to see if you’re exempt or not.

Conclusion of how to calculate percentage gst

At the end of the day, knowing how to calculate percentage gst accurately is essential for businesses and individuals worldwide. It helps you stay tax-compliant, make more precise financial decisions, and prevent errors that could cost money and time. We hope this article has answered your queries and made the whole process more transparent and understandable. If you have any questions, feel free to reach out to a tax professional or an accountant for more information.

Gallery

Calculate.co.nz – GST Calculator

Photo Credit by: bing.com /

Excel Formula For Reverse Tax Calculation | Excel Formula, Reverse, Excel

Photo Credit by: bing.com / calculator calculate calculation including subtract 2065 excluding quora

How To Calculate Percentage In Excel? ( Discount, GST, Margin, Change

Photo Credit by: bing.com / gst excel calculation calculate percent

How To Calculate Percentage: Solve Through Percentage Formula

Photo Credit by: bing.com / solve

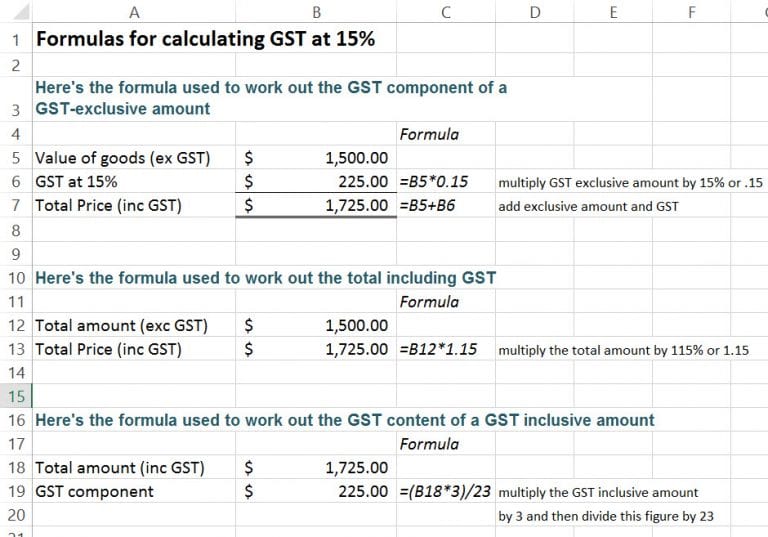

How To Calculate GST At 15% Using Excel Formulas | Excel At Work

Photo Credit by: bing.com / gst calculate excel formulas percent nz using amount work tutorial below show video