If you’re someone who struggles with math, knowing how to calculate percentage loss in maths can be particularly difficult. But did you know that calculating percentage loss is a crucial skill that can benefit you in many areas of your personal and professional life? In this blog post, we’ll dive into the topic of how to calculate percentage loss in maths and make it easier to understand.

Have you ever looked at your bank account and realized that there’s less money than you thought there would be? Or maybe you’ve lost money on an investment and you’re not sure what happened. Understanding how to calculate percentage loss can help you better understand where your money is going and how to prevent future losses.

Calculating percentage loss may seem intimidating at first, but it’s a simple calculation that can be broken down into a few easy steps. First, subtract the final value from the initial value. Next, divide the result by the initial value. Finally, multiply by 100 to get the percentage.

In conclusion, learning how to calculate percentage loss in maths is an essential skill that can help you make better financial decisions. By following the simple steps mentioned in this post, you can easily calculate percentage loss and understand where your money is going. So don’t be intimidated by math – start practicing this skill today!

What is Percentage Loss?

Percentage loss is a term used in finance to describe the loss of value of an investment or asset over time. It is calculated by taking the difference between the initial value and the final value of an investment, dividing it by the initial value, and then multiplying it by 100 to get the percentage.

When I first started investing, I was constantly losing money and couldn’t figure out why. But then I learned about percentage loss and started tracking my investments more closely. By doing this, I was able to identify which investments were performing poorly and cut my losses before it was too late.

How to Calculate Percentage Loss?

Now, let’s dive into how to calculate percentage loss in more detail. As mentioned earlier, the calculation involves three simple steps – subtract, divide, and multiply. Here’s an example to help you understand the process:

If you bought a stock for $100 and it’s now worth $80, the calculation for percentage loss would be:

Step 1: $100 – $80 = $20

Step 2: $20 / $100 = 0.2

Step 3: 0.2 x 100 = 20%

Therefore, the percentage loss is 20%.

Why is Calculating Percentage Loss Important?

Calculating percentage loss is important for several reasons. First, it helps you identify which investments are performing poorly and which ones are worth keeping. It also helps you make informed decisions about buying and selling stocks or other assets. By calculating percentage loss, you can avoid making impulsive decisions that could lead to further losses.

Tips for Calculating Percentage Loss

Calculating percentage loss can be daunting, especially if you’re not good with numbers. Here are a few tips to help you make the process easier:

- Use a calculator – this will help you avoid making errors

- Keep accurate records – this will make it easier to track your investments and identify trends over time

- Don’t be afraid to ask for help – if you’re struggling with a particular calculation, don’t be afraid to reach out to a financial advisor or someone with more experience in the field

Common Questions About Calculating Percentage Loss

1. What is the difference between percentage gain and percentage loss?

The main difference between percentage loss and percentage gain is the direction in which the value is moving. Percentage loss represents a decrease in value, while percentage gain represents an increase in value. The calculation for both is the same, but the final result will either be positive or negative depending on whether you’re calculating gain or loss.

2. Can you have a negative percentage loss?

No, a negative percentage loss is actually a percentage gain. If the final value is greater than the initial value, the result will be a positive number indicating percentage gain.

3. How can I use percentage loss to make better investment decisions?

By calculating percentage loss, you can identify which investments are performing poorly and cut your losses before it’s too late. You can also use this information to spot trends over time, identify which investments are worth keeping, and make informed decisions about buying and selling stocks or other assets.

4. How often should I calculate percentage loss?

It’s a good idea to calculate percentage loss on a regular basis, such as monthly or quarterly. This will help you track your investments and identify trends over time.

Conclusion of How to Calculate Percentage Loss in Maths

Calculating percentage loss in maths can be a valuable tool for anyone who wants to make better financial decisions. By following the simple steps outlined in this post, you can easily calculate percentage loss and gain a better understanding of where your money is going. If you’re still struggling, don’t be afraid to reach out to a financial advisor or other expert for help. With practice, you’ll become a pro at calculating percentage loss in no time!

Gallery

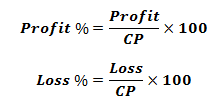

Profit And Loss As Percentage – Formula, Examples, Techniques

Photo Credit by: bing.com / profit loss percentage formula maths

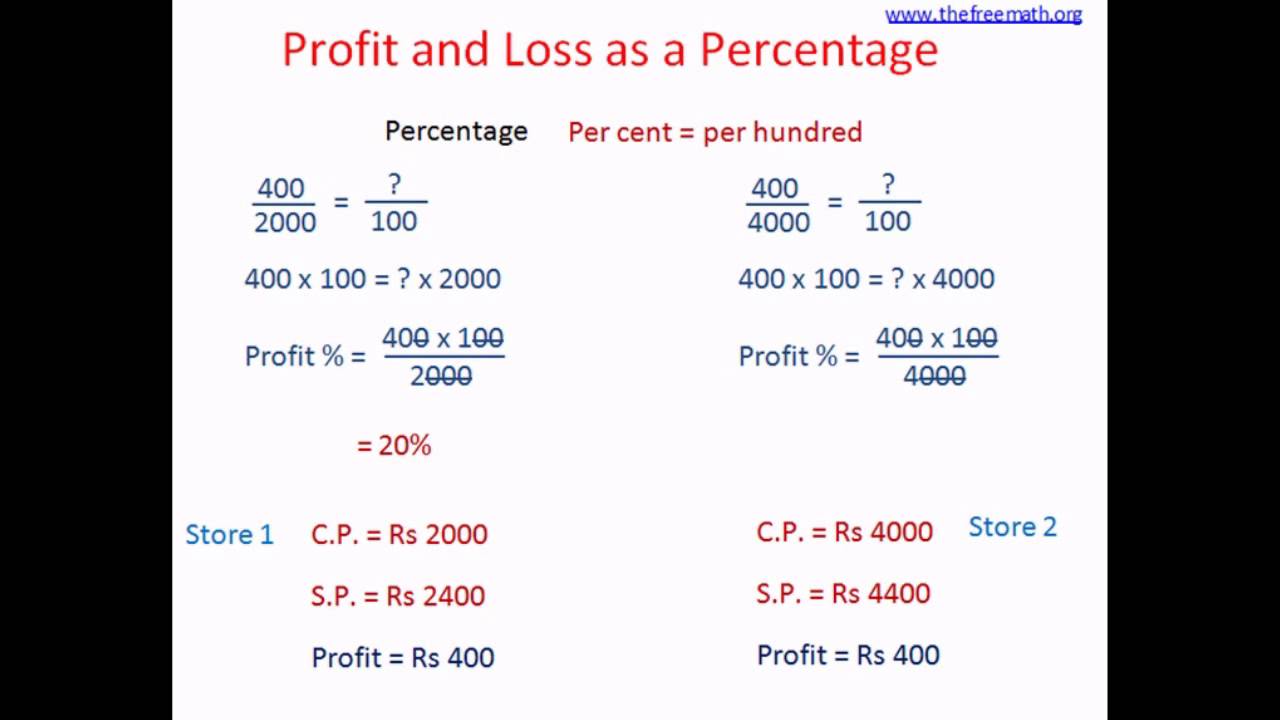

Percentage Formula In Maths – Howto Diy Today

Photo Credit by: bing.com /

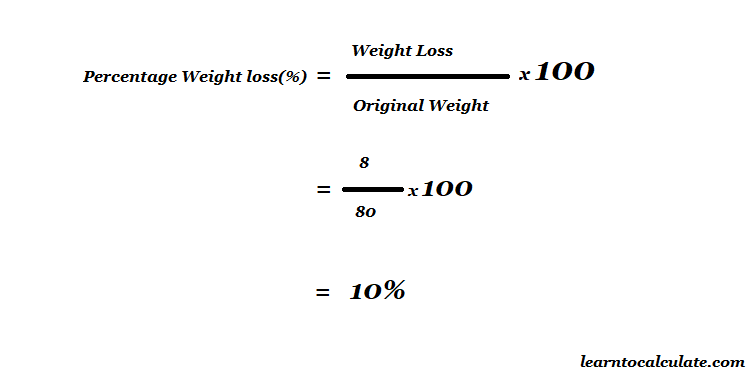

16+ Discount Percentage Formula In Profit And Loss Images – Discount Walls

Photo Credit by: bing.com /

Percentage Calculator – India Dictionary

Photo Credit by: bing.com /

Calculate Percentage Change

Photo Credit by: bing.com / percentage calculate