Are you tired of feeling lost and confused when it comes to calculating the percentage of tax deducted from your earnings? Learning to calculate tax deductions can be a daunting task, but it’s a skill that everyone should have. In this post, we will guide you through the steps to help you understand how to accurately calculate the percentage of tax deducted from your earnings.

For many people, calculating the percentage of tax deducted from their earnings can be a painful process. This is especially true if you are not familiar with tax laws and regulations. It can be overwhelming to figure out what percentage of your income you should set aside for taxes, and how to go about doing so. Not to worry, we are here to make the process a little easier for you!

To calculate the percentage of tax deducted from your earnings, you need to know your taxable income, tax rate, and any applicable deductions. Once you have this information, calculating your tax liability is a straightforward process. Simply multiply your taxable income by your tax rate to get your total tax liability.

In summary, understanding how to calculate the percentage of tax deducted from your earnings requires you to know your taxable income, tax rate, and applicable deductions. Once you have this information, calculating your tax liability is easy.

Calculating Tax Deductions: Understanding Taxable Income

When it comes to calculating tax deductions, it all starts with understanding your taxable income. Taxable income is the amount of money you earn that is subject to taxation. This includes wages, salaries, bonuses, and tips. It also includes income from self-employment, investments, and rental properties. To calculate your taxable income, you need to subtract any applicable deductions from your gross income.

For example, if you earn $50,000 a year and have $10,000 in deductions, your taxable income would be $40,000. Once you have this figure, you can then determine your tax rate and calculate your tax liability.

Figuring Out Your Tax Rate: How Tax Brackets Work

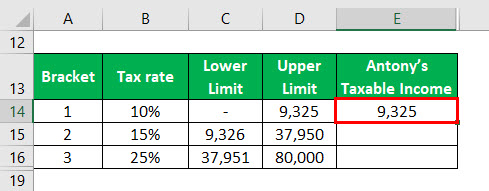

Your tax rate is determined by your income and tax bracket. Tax brackets are a range of income levels that are taxed at a certain rate. The United States has a progressive tax system, which means that as your income increases, so does your tax rate.

Your tax rate is not a flat percentage of your income, but rather a percentage that is applied to different segments of your income. For example, let’s say that you are a single taxpayer with a taxable income of $50,000. For the 2021 tax year, your first $9,950 of income is taxed at a rate of 10%, the next $9,951 to $40,525 is taxed at 12%, and any income above $40,525 is taxed at a rate of 22%.

Don’t Forget about Deductions and Credits

When calculating your tax deductions, deductions and credits can help reduce the amount of taxes you owe. Deductions are expenses that reduce your taxable income, such as charitable donations or student loan interest. Credits are dollar-for-dollar reductions in your tax liability, such as the Child Tax Credit or Earned Income Tax Credit. Make sure to research and take advantage of any applicable deductions and credits that you qualify for.

Double-Check Your Work

Before submitting your tax return, make sure to double-check your work. Double-checking your calculations and making sure you have all the necessary documents can save you from any headaches come tax season.

Putting It All Together: An Example Calculation

Let’s put this all together with an example calculation. Let’s say you are a single taxpayer with a taxable income of $50,000 for the 2021 tax year. Using the tax brackets we mentioned earlier, your tax liability would be calculated as follows:

- 10% of the first $9,950 of income = $995

- 12% of $9,951 to $40,525 of income = $3,573.30

- 22% of the remaining $9,475 of income = $2,084.50

- Total tax liability = $6,652.80

Remember, this is just an example calculation. Your tax liability will vary based on your specific circumstances. Make sure to consult with a tax professional for personalized advice.

Question and Answer Section

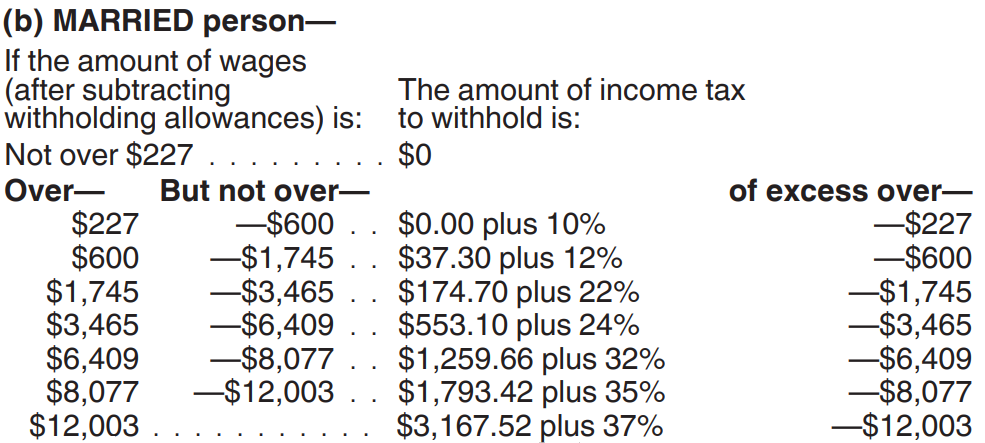

Q: How is tax deducted from my paycheck?

A: Tax is usually deducted from your paycheck automatically by your employer using the IRS’s withholding tables. The amount that is withheld depends on the information you provided on your Form W-4, such as your filing status and the number of allowances you claimed.

Q: Can I deduct contributions to a 401(k) or IRA from my taxable income?

A: Yes, contributions to a 401(k) or IRA can be deducted from your taxable income. This can help lower your tax liability and increase your retirement savings at the same time.

Q: What happens if I don’t pay my taxes?

A: If you don’t pay your taxes, the IRS can impose penalties and interest on the amount owed. In severe cases, they may even seize your property or wages to pay the debt.

Q: Can I get help with my taxes?

A: Yes, there are many resources available to help you with your taxes. You can consult with a tax professional, use tax software, or check out the IRS website for guidance.

Conclusion of How to Calculate Percentage of Tax Deducted

Calculating the percentage of tax deducted from your earnings may seem intimidating at first, but it is a necessary skill to have. By understanding your taxable income, tax rate, and any applicable deductions, you can confidently calculate your tax liability and stay on top of your finances. Remember, if you ever feel overwhelmed, there are many resources available to help you.

Gallery

How To Calculate Payroll And Income Tax Deductions – PEO & Human

Photo Credit by: bing.com / deductions payroll

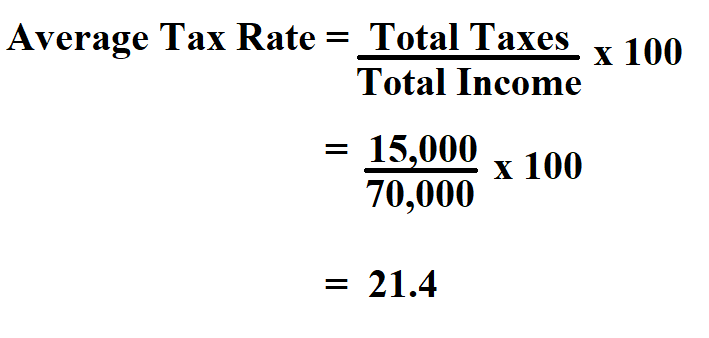

Effective Tax Rate Formula | Calculator (Excel Template)

Photo Credit by: bing.com / tax rate effective formula protection example excel calculation calculate calculator bracket template

How To Calculate Average Tax Rate.

Photo Credit by: bing.com / tax calculate liability

Complete Guide To Quarterly Percentage Tax (BIR Form 2551Q)

Photo Credit by: bing.com / percentage calcolare percentuale kredit businessperson montant menghitung diskon persen bri calcola calcolo pastikan antisipasi pencadangan memadai kualitas calculating htva calculer

Mathematics For Work And Everyday Life

Photo Credit by: bing.com / tax income pay percentage equation calculation calculating deductions rate deduction gross work mathematics exported