In today’s economy, loans have become an integral part of our lives; whether it’s to finance a new home, a car, or a small business, loans are essential. However, understanding how to calculate percentage on loan can be a struggle for many. In this article, we’ll break down everything you need to know about calculating percentage on loans, so you can make informed decisions.

When it comes to loans, there are several pain points that can be confusing for borrowers. One common problem is figuring out how much interest you’ll pay over the life of a loan. Additionally, understanding the difference between the interest rate and the annual percentage rate (APR) can be challenging. Knowing how to calculate percentage on loan can give you the tools you need to understand the true cost of borrowing.

The formula to calculate percentage on loan is straightforward. To figure out the interest you will owe, you need to multiply the amount borrowed by the interest rate and the length of the loan in years. The result is the total interest paid on the loan. For example, if you borrowed $10,000 at a 5% interest rate for 5 years, you would owe $2,578 in interest.

In conclusion, knowing how to calculate percentage on loan is crucial for anyone considering borrowing money. By understanding how interest works and how to calculate it correctly, you can make better-informed decisions about your finances. Always remember to compare different loan offers and get quotes from several lenders before making a final decision.

How to Calculate the Total Cost of a Loan

When it comes to borrowing, it’s essential to consider the overall cost of the loan, not just the interest rate. In addition to interest, there may be fees and other charges associated with the loan. To calculate the total cost of the loan, you need to add up all the fees and charges and add them to the total amount of interest you’ll pay over the life of the loan. The sum is the total cost of the loan.

For example, if you borrowed $10,000 at a 5% interest rate for five years and incurred $500 in fees, your total cost of borrowing would be $13,078.

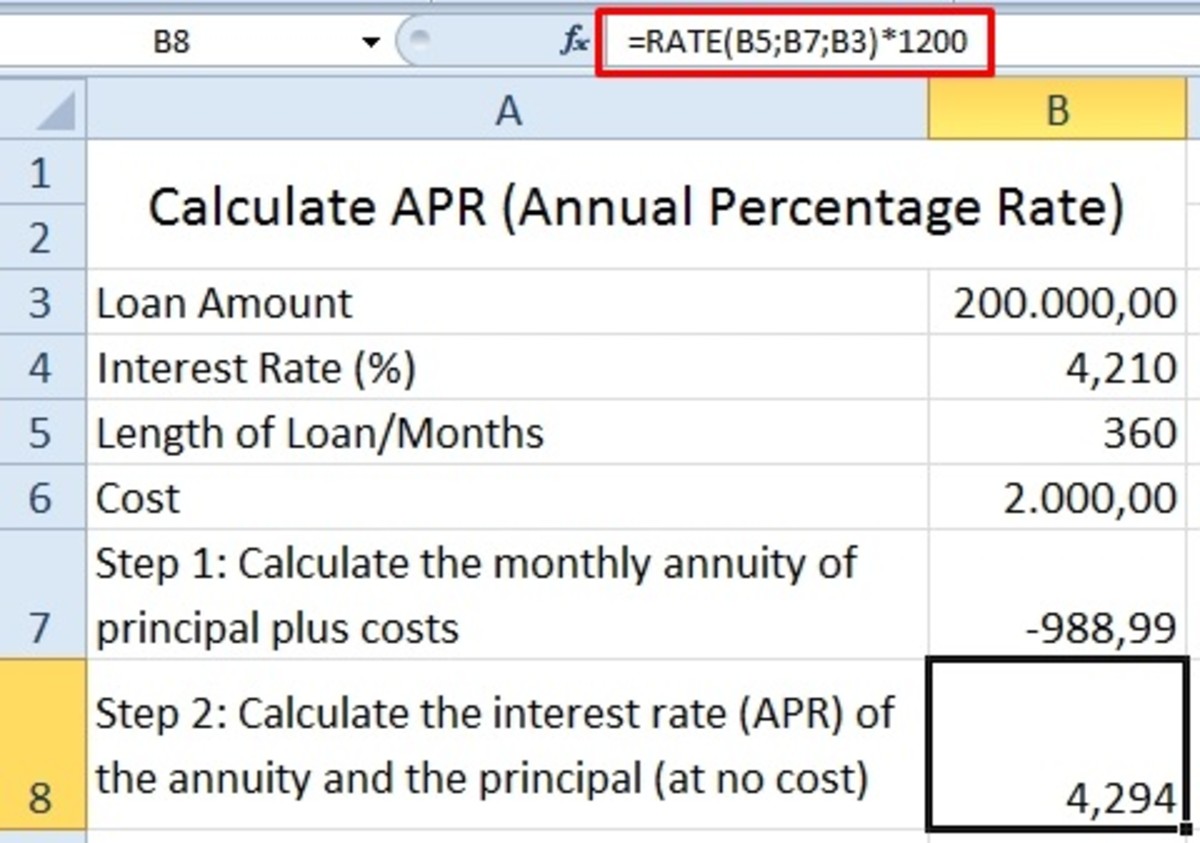

How to Calculate the APR

The APR is the annual percentage rate, and it’s different from the interest rate in that it includes all fees and costs associated with the loan. To calculate the APR, you need to add up all the fees and charges and add them to the total amount of interest you’ll pay over the life of the loan. You then divide that number by the total amount borrowed and multiply it by 100.

For example, if you borrowed $10,000 at a 5% interest rate for five years and incurred $500 in fees, your APR would be 6.24%.

Factors That Affect Loan Interest Rates

Several factors affect loan interest rates, including credit score, loan term, loan type, and the lender’s policies. To receive the best interest rate possible, you should work on improving your credit score, compare loan offers from several lenders, and choose the loan with the lowest interest rate and fees.

The Importance of Paying Extra on Your Loan Payments

Paying extra on your loan payments can help you pay off the loan faster and save you money on interest. By making an extra payment each year, you can reduce the length of your loan and pay less interest overall.

Question and Answer

Q: Can I negotiate loan interest rates with lenders?

A: Yes, you can negotiate loan interest rates with lenders by shopping around for different lenders and comparing loan offers. Additionally, having a good credit score and a stable source of income can help you negotiate a better interest rate.

Q: Is it better to take out a loan with a fixed or variable interest rate?

A: It depends on your situation. A fixed interest rate provides more stability because the rate stays the same throughout the loan term. A variable interest rate can be more beneficial if interest rates drop in the future, but it can also increase if interest rates go up.

Q: What is the difference between simple interest and compound interest?

A: Simple interest is calculated based on the principal amount borrowed, while compound interest is calculated based on the principal amount plus the accumulated interest. Compound interest can result in more interest paid over the life of the loan.

Q: Can I pay off my loan early without incurring penalties?

A: It depends on the loan agreement. Some loans have prepayment penalties, which means you’ll incur a fee if you pay off the loan early. Other loans allow for early payment without penalties. Always read the loan agreement carefully to understand the terms and conditions.

Conclusion of How to Calculate Percentage on Loan

Knowing how to calculate percentage on loan is essential for anyone considering borrowing money. By understanding how interest works and how to calculate it correctly, you can make better-informed decisions about your finances. Before taking out a loan, always consider the overall cost of borrowing, compare loan offers from multiple lenders, and choose the loan with the lowest interest rate and fees. Paying extra on your loan payments can help you pay off the loan faster and save money on interest over the life of the loan.

Gallery

How To Calculate Effective Interest Rate Using Excel | ToughNickel

Photo Credit by: bing.com / annuity calculator apr percentage principle

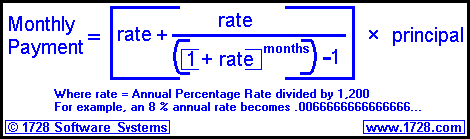

Loan Payment Formula

Photo Credit by: bing.com / payment monthly annual loan formula percentage rate years borrow cent per if 1728

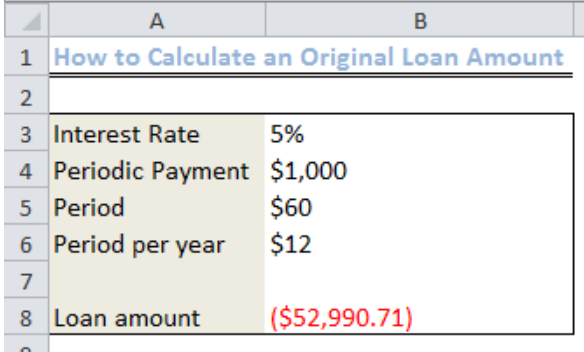

Excel Tip: Calculating Interest » DavidRingstrom.com

Photo Credit by: bing.com / excel interest loan calculating pmt monthly figure payment function calculates tip payments accountingweb period

How To Find The Number Of Payments On A Loan In Excel – NOALIS

Photo Credit by: bing.com / calculate formula payments mortgage

How To Calculate Loan To Value Percentage – LOAKANS

Photo Credit by: bing.com /