In today’s economy, it’s more important than ever to stay on top of your budget. But what do you do when you realize you’ve gone over budget? Fear not, as calculating the percentage over budget is simple once you understand the process.

Whether you’re an individual trying to manage personal finances or a business trying to stick to a budget, going over budget can be frustrating and stressful. It can lead to missed opportunities, financial strain, and cause delays in achieving financial goals.

To calculate the percentage over budget, start by subtracting the budgeted amount from the actual amount spent. The result is the amount over budget. Then, divide the amount over budget by the budgeted amount and multiply the result by 100 to get the percentage over budget.

In summary, to calculate the percentage over budget:

- Subtract the budgeted amount from the actual amount spent

- Divide the result by the budgeted amount

- Multiply the result by 100 to get the percentage over budget

Understanding the Calculation Process and Applying it in Real Life

Let’s say, for example, that you budgeted $1,000 for a home renovation project but ended up spending $1,200 instead. To calculate the percentage over budget, subtract the budgeted amount from the actual amount spent ($1,200 – $1,000 = $200). Then, divide the amount over budget by the budgeted amount ($200 ÷ $1,000 = 0.2). Finally, multiply the result by 100 to get the percentage over budget (0.2 x 100 = 20%). Therefore, you went over budget by 20% in this scenario.

It’s important to keep track of your budget and monitor any variances to ensure financial success. Utilizing tools such as financial software, spreadsheets, and budgeting apps can help make this process easier.

Why Knowing How to Calculate Percentage Over Budget is Important

Knowing how to calculate percentage over budget is crucial not just for budgeting purposes, but also for making informed financial decisions. It can help you identify areas where you may be overspending and allow you to adjust your spending habits accordingly. For businesses, it can help identify areas where money can be saved or reinvested, leading to increased profits and growth. Additionally, being able to calculate the percentage over budget can help you decide whether a certain expense is worth it, or if it’s time to cut back on spending.

The Importance of Monitoring Budgets

When it comes to budgeting, monitoring your budget is just as important as creating one. By monitoring your budget, you can identify trends in spending and adjust your budget accordingly. It also helps you avoid overspending and falling into debt, which can ultimately lead to financial ruin.

The Benefits of Budgeting

While budgeting can seem daunting at first, the benefits are well worth the effort. Budgeting can help you achieve your financial goals, reduce financial stress and anxiety, and lead to better financial decisions overall. It’s important to create a budget that is realistic and achievable, and to review it regularly to ensure success.

Putting It All Together

Knowing how to calculate percentage over budget is an important skill to have for anyone looking to improve their financial well-being. By understanding the calculation process and monitoring your budget regularly, you can make informed financial decisions and achieve your financial goals. Remember, budgeting is a journey, not a destination. It takes time, effort, and discipline, but the rewards are well worth it.

Question and Answer

Q: Can’t I just use a percentage calculator to determine the percentage over budget?

A: While there are many online percentage calculators available, it’s important to understand the calculation process in case of discrepancies or errors. Additionally, understanding the calculation process can help you make more informed financial decisions.

Q: What should I do if I find that I’ve gone over budget?

A: If you find that you’ve gone over budget, the first step is to identify the reason why. Then, you can adjust your budget and spending habits accordingly. It’s important to rectify any overspending as soon as possible to avoid falling into debt.

Q: How often should I monitor my budget?

A: You should monitor your budget regularly, ideally monthly or weekly. This allows you to identify trends in spending and adjust your budget accordingly. It also helps you avoid overspending and falling into debt.

Q: Can I still achieve my financial goals if I go over budget?

A: Going over budget can make it harder to achieve financial goals, but it’s not impossible. By adjusting your budget and spending habits, you can still make progress towards your financial goals.

Conclusion of How to Calculate Percentage Over Budget

Calculating the percentage over budget is a crucial skill for anyone looking to improve their financial well-being. By understanding the calculation process and monitoring your budget regularly, you can identify areas of overspending and adjust accordingly. By making informed financial decisions, you can achieve your financial goals and reduce financial stress and anxiety.

Gallery

How To Calculate The Percentage Of An Over-Budgeted Amount | Nasdaq

Photo Credit by: bing.com / percentage budgeted amount nasdaq analyzing

How To Calculate The Percentage Of An Over-Budgeted Amount | Nasdaq

Photo Credit by: bing.com / nasdaq calculate

Pin On BUDGETING – GROUP BOARD

Photo Credit by: bing.com / budget percentages budgeting tips money saving monthly financial recommended category plan chart planning finance personal income planner friendly activities peace

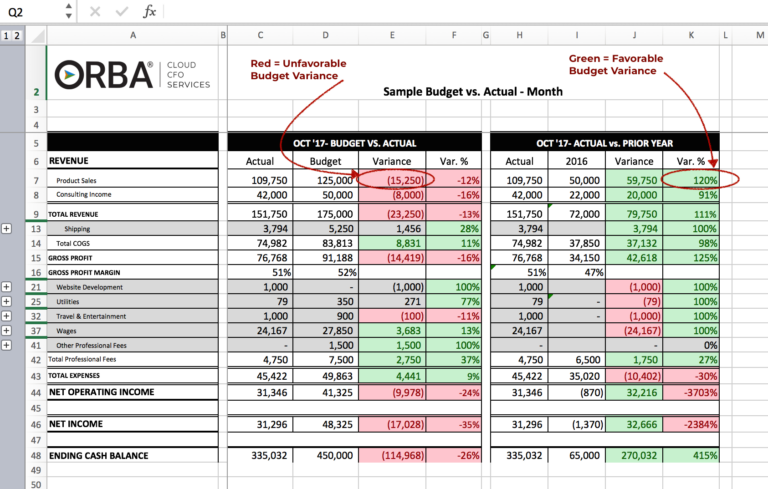

How To Monitor And Understand Budget Variances | ORBA Cloud CFO

Photo Credit by: bing.com / variance variances monthly understand divide budgeted

How To Calculate The Percentage Of An Over-Budgeted Amount | Nasdaq

Photo Credit by: bing.com / calculate budgeted nasdaq