If you’re a property owner, investor, or business owner, you may have found yourself wondering how to calculate percentage ownership. Understanding percentage ownership is essential for determining your portion of profits or losses, voting rights, and decision-making power. Whether you’re looking to buy a property or are already a co-owner, this post will guide you through the process of calculating percentage ownership.

The pain points of calculating percentage ownership

Calculating percentage ownership can be confusing and stressful, especially if you’re dealing with complex ownership structures or multiple owners. You may be unsure of how to determine your percentage ownership, what factors to consider, or how to negotiate ownership percentages with other parties. This lack of knowledge can lead to misunderstandings, disputes, or financial losses.

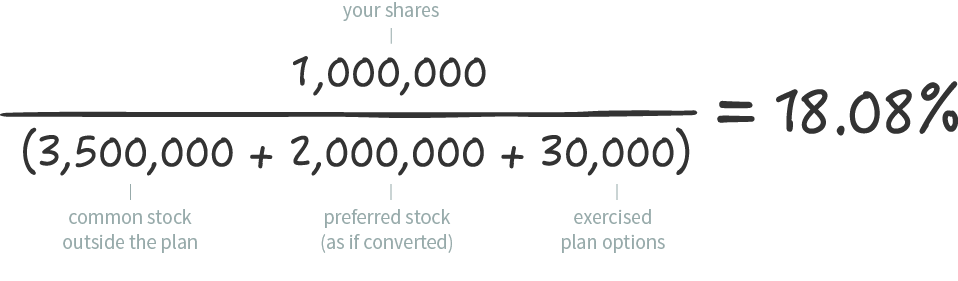

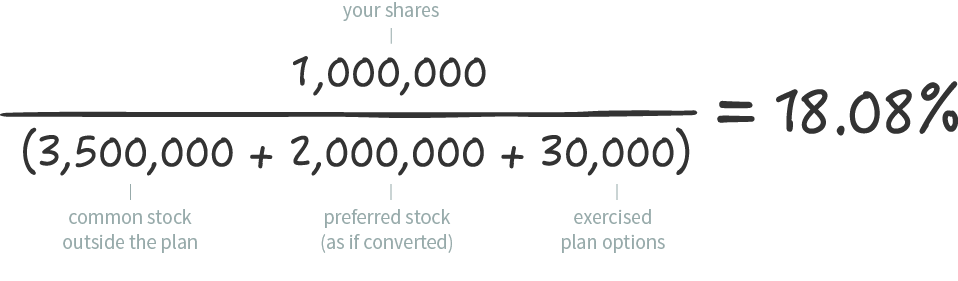

How to calculate percentage ownership

To calculate the percentage ownership of a property, business, or investment, you need to know the total value of the asset and the value of your share. Here’s the formula:

Percentage Ownership = (Your Share / Total Value) x 100%

For example, suppose you and your two friends decide to buy a rental property worth $600,000. You contribute $150,000, while your friends contribute $200,000 and $250,000, respectively. To calculate your percentage ownership, you would divide your share by the total value and multiply by 100%:

Percentage Ownership = ($150,000 / $600,000) x 100% = 25%

Summary of how to calculate percentage ownership

To calculate percentage ownership, determine the total value of the asset and the value of your share, then use the formula: Percentage Ownership = (Your Share / Total Value) x 100%. This process can be challenging, especially when dealing with multiple owners or complex ownership structures. However, understanding your percentage ownership is crucial for making informed decisions, negotiating deals, and protecting your rights and interests.

Calculating percentage ownership in practice

When I first started investing in real estate, I was overwhelmed by the legal and financial jargon involved. One of the biggest challenges I faced was calculating my percentage ownership in a property and understanding how it affected my ROI. However, over time, I learned some tips and tricks that made the process easier.

To calculate percentage ownership accurately, you need to take into account any outstanding debts, mortgages, or liens on the property. These can affect the value of the asset and reduce your percentage ownership. You should also ensure that the ownership structure is well-defined and legally binding, with clear terms and conditions.

Factors affecting percentage ownership

Several factors can affect your percentage ownership, including the type of ownership structure, the amount of equity you have, and any outstanding debts or liabilities. It’s crucial to review these factors carefully and seek legal or financial advice if necessary to ensure that you understand your percentage ownership.

Maximizing your percentage ownership

If you’re looking to maximize your percentage ownership, there are several strategies you can use. One is to negotiate favorable terms with other co-owners or investors, such as by offering to contribute a higher percentage of the capital or assuming a greater share of the risks. Another is to improve the value of the asset itself, such as by making renovations or increasing occupancy rates.

Question and Answer

Q. Can I increase my percentage ownership over time?

A. Yes, you can increase your percentage ownership by contributing more capital, assuming more risks, or negotiating favorable terms with other owners. However, it’s essential to consider the legal and financial implications of these strategies and seek professional advice if necessary.

Q. Is percentage ownership the same as voting rights?

A. Not necessarily. While your percentage ownership may affect your voting rights, especially in corporate or nonprofit structures, there may be other factors to consider, such as the type of shares you hold, the bylaws or articles of incorporation, or the nature of the decision being made.

Q. Can I sell or transfer my percentage ownership to someone else?

A. Yes, you can sell or transfer your percentage ownership to another party, subject to any legal or contractual restrictions. However, it’s crucial to understand the tax implications, the market value of your ownership stake, and any potential risks or liabilities.

Q. What happens if there are disputes or conflicts over percentage ownership?

A. Disputes over percentage ownership can be costly, time-consuming, and damaging to relationships. It’s essential to have clear and comprehensive ownership agreements in place, seek mediation or arbitration if necessary, and respect each other’s rights and interests. Legal or financial advice can also be helpful in resolving disputes.

Conclusion of how to calculate percentage ownership

Calculating percentage ownership can be a challenging but essential task for any property owner, investor, or business owner. By understanding the formula, factors affecting percentage ownership, and best practices for maximizing your stake, you can make informed decisions, negotiate deals, and protect your rights and interests. Remember to seek professional advice if necessary and always communicate clearly and respectfully with other parties.

Gallery

How To Calculate Percentage With The Easiest Percentage Formula

Photo Credit by: bing.com / calculate formula representation graphical easiest

How To Calculate The Percentage Ownership Of A Tenant In Common (TIC)

Photo Credit by: bing.com / ownership percentage tic

Calculating Percentage Of Ownership: Hooray For New Math!

Photo Credit by: bing.com / hooray calculating schooler

Stock Percentage Change Calculator – RoyLizbeth

Photo Credit by: bing.com /

How To Calculate Percentage: Solve Through Percentage Formula

Photo Credit by: bing.com / percentage calculate formula solve through