If you’re planning on buying a car but don’t have enough cash to pay upfront, you’re not alone. Many people are in the same boat, and the solution is to take out a car loan. However, understanding how the percentage rate on car loans work can be confusing, and it’s important to know what you’re getting into before you sign on the dotted line. In this blog post, we’ll explore how to calculate the percentage rate on car loans and give you the knowledge you need to make an informed decision.

Buying a car is often one of the biggest financial decisions that people make, and it’s important to understand the implications of taking out a car loan. The interest rate on these loans can often be high, and if you don’t understand how it works, you could end up paying more than you anticipated. Additionally, not being able to make the monthly payments on your car loan can lead to repossession, which can have a significant impact on your credit score.

When calculating the percentage rate on a car loan, there are a few factors that you’ll need to take into consideration. First, you’ll need to know the amount of the loan. Second, you’ll need to know the interest rate that you’ve been quoted. Finally, you’ll need to know the length of the loan. Armed with this information, you can calculate the percentage rate on your car loan using a simple formula.

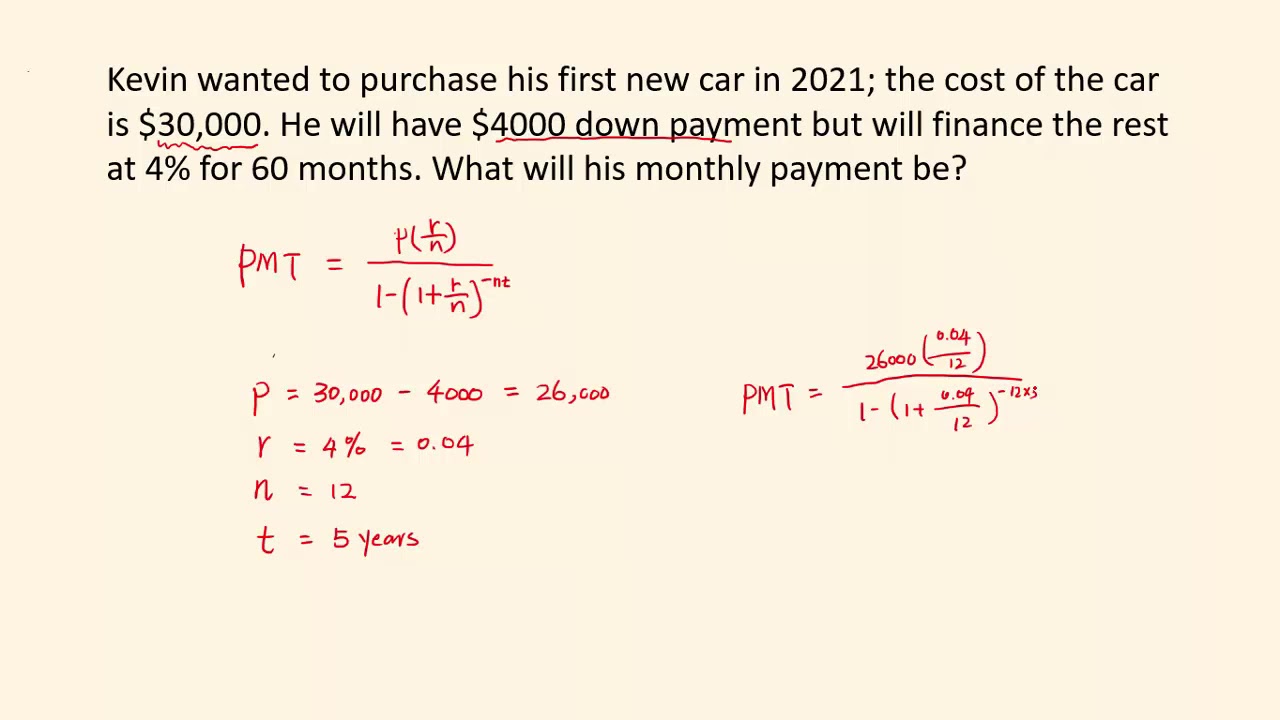

To calculate the percentage rate on a car loan, you’ll need to use the following formula:

How to calculate percentage rate on car loan – Formula:

Annual Percentage Rate (APR) = ((Monthly payment * Months of loan) / Loan amount) * 100

Let’s say you want to buy a car for $20,000, and you’ve been approved for a 60-month loan with an interest rate of 5%. Your monthly payment would be $377.42. Using the formula, we can calculate the APR:

(($377.42 * 60) / $20,000) * 100 = 6.13%

So, in this scenario, the APR for your car loan is 6.13%. This means that over the course of the loan, you’ll be paying an extra 6.13% on top of the original loan amount.

In summary, knowing how to calculate the percentage rate on car loans is an important part of making an informed decision when buying a car. By understanding the formula and the factors that go into determining the rate, you can ensure that you’re getting a fair deal.

My experience with calculating percentage rate on car loans:

When I bought my first car, I didn’t fully understand how the percentage rate on car loans worked. I focused on the monthly payment amount, but I didn’t take into consideration the interest rate, which turned out to be much higher than I anticipated. As a result, I ended up paying more for my car than I had planned, and it took me longer to pay it off than I expected. Now that I understand how to calculate the percentage rate on a car loan, I feel much more confident in my ability to make informed financial decisions.

Factors that affect the percentage rate on car loans:

There are a few factors that can affect the percentage rate on car loans. These include:

1. Credit score:

Your credit score is one of the most important factors that car loan lenders consider. If you have a high credit score, you’re more likely to be offered a lower interest rate. Conversely, if you have a low credit score, you may be offered a higher interest rate.

2. Loan term:

The length of the loan can also have an impact on the interest rate. Generally, shorter-term loans have lower interest rates than longer-term loans. This is because the lender is taking on less risk with a shorter-term loan.

3. Type of vehicle:

The type of vehicle you’re buying can also affect the interest rate. New cars typically have lower interest rates than used cars, and some lenders may offer higher rates for luxury or sports cars.

Question and Answer section:

Q: Can I negotiate the interest rate on my car loan?

A: Yes, you can negotiate the interest rate on your car loan. Shop around for different lenders, and don’t be afraid to negotiate to get the best deal.

Q: Is it better to get a short-term or long-term car loan?

A: It depends on your financial situation. Short-term loans typically have lower interest rates, but the monthly payments will be higher. Long-term loans have higher interest rates, but the monthly payments will be lower. Consider your budget and financial goals when deciding which type of loan to get.

Q: Can I pay off my car loan early?

A: Yes, you can pay off your car loan early. However, some lenders may charge a prepayment penalty, so be sure to read the terms of your loan agreement carefully.

Q: What is a good APR for a car loan?

A: The average APR for a car loan is around 4% to 5%. However, the rate you’re offered will depend on several factors, including your credit score, the length of the loan, and the type of vehicle you’re buying.

Conclusion of how to calculate percentage rate on car loan:

Calculating the percentage rate on a car loan can be confusing, but it’s an important part of making an informed financial decision. By understanding how the rate is calculated and what factors can affect it, you can ensure that you’re getting the best deal possible. Remember to shop around for different lenders and negotiate to get the best interest rate for your car loan.

Gallery

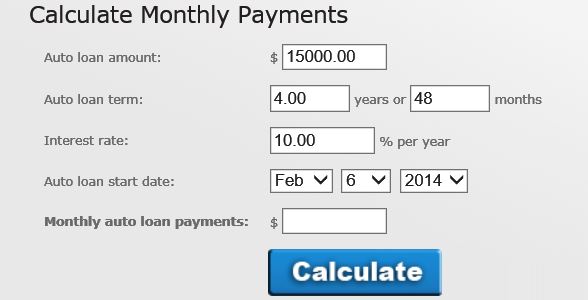

Calculate Monthly Payment And Total Interest For A Car Loan – YouTube

Photo Credit by: bing.com / loan calculate payment

How To Find The Best Car Loan Rate | YourMechanic Advice

Photo Credit by: bing.com / car loan calculator rates rate find calcs biz

Car Loan Calculator

Photo Credit by: bing.com / loan calculator interest car only ncalculators

Annual Percentage Rate (APR) Definition

:max_bytes(150000):strip_icc()/Clipboard01-5c525fc14cedfd0001f91622.jpg)

Photo Credit by: bing.com / percentage investopedia loans

Good Content In Boring Industries: The Car Loan Calculator | The Better

Photo Credit by: bing.com / calculator loan car good industries boring rate jordan sam