If you’re a commercial tenant or landlord, you’ve likely encountered the term “percentage rent” in your lease. Knowing how to calculate percentage rent is crucial to determining your rent payments and managing your finances. In this article, we’ll break down the process of how to calculate percentage rent and provide tips to help you navigate this complex area.

Figuring out how to calculate percentage rent can be confusing and overwhelming, especially for those who are new to commercial leasing. If you make a mistake in calculating your percentage rent, it can lead to financial issues and disagreements with your landlord or tenant. Additionally, not all leases have the same formulas, so you need to understand the specific terms of your lease before you can start calculating.

The first step to figuring out how to calculate percentage rent is to determine your base rent. This is the minimum amount of rent that the landlord will charge you regardless of your sales or revenue. Your base rent may be monthly, quarterly, or annual, depending on the terms of your lease. Once you know your base rent, you can move on to calculating your percentage rent.

In summary, to calculate percentage rent, follow these steps:

Step 1: Determine your base rent

Your base rent is the minimum amount of rent that you are required to pay each month, quarter, or year. This amount is usually included in your lease agreement.

For example, let’s say your base rent is $2,000 per month.

Step 2: Determine the percentage rate

Your lease agreement should specify the percentage rate that will be used to calculate your percentage rent. This rate may be a fixed percentage or a percentage that increases as your sales or revenue increase.

For example, let’s say your percentage rate is 5%.

Step 3: Calculate your percentage rent

To calculate your percentage rent, multiply your base rent by the percentage rate.

For example, using the base rent and percentage rate from the previous steps:

$2,000 x 5% = $100

Therefore, your percentage rent would be $100.

Understanding the complexities of percentage rent

Calculating percentage rent isn’t always straightforward. Some leases have complicated formulas that consider various factors such as gross sales, net sales, and breakpoints.

Gross sales refer to the total revenue earned during a specific period, while net sales are the revenue earned after deductions. Breakpoints are specific revenue amounts at which the percentage rate increases or decreases.

It’s essential to read your lease agreement carefully and seek professional advice if you’re unsure about the terms of your lease.

Benefits of percentage rent

Percentage rent can be an advantageous arrangement for both commercial landlords and tenants. For tenants, percentage rent can be more affordable, as it ties rent payments to revenue. For landlords, percentage rent can provide an incentive for tenants to perform well and increase their sales, leading to higher rental income.

Common mistakes to avoid when calculating percentage rent

Miscalculations of percentage rent can cause financial disputes and legal issues. Common mistakes to avoid when calculating percentage rent include:

1. Misunderstanding or misinterpreting the terms of the lease agreement.

2. Failing to account for breakpoints or other complicated lease factors.

3. Applying the incorrect percentage rate or formula.

To avoid these mistakes, it’s essential to carefully read and understand your lease agreement and seek professional advice if necessary.

Question and Answer section

Q1. What is percentage rent in commercial leasing?

A: Percentage rent is a lease agreement in which a commercial tenant pays a base rent plus an additional rent based on a percentage of their sales or revenue.

Q2. How is percentage rent calculated?

A: To calculate percentage rent, you need to determine your base rent and percentage rate, then multiply them together. Some leases may have complicated formulas that require additional steps.

Q3. What factors affect percentage rent?

A: The percentage rate used to calculate percentage rent can vary based on several factors, including the type of business, location, industry trends, and the landlord’s preferences.

Q4. Are there any drawbacks to percentage rent?

A: One potential downside to percentage rent is that it can be complicated and difficult to calculate correctly. Additionally, if a tenant’s sales or revenue decrease, their rent payments may decrease, leading to cash flow issues for the landlord.

Conclusion of how to calculate percentage rent

Calculating percentage rent is a critical aspect of commercial leasing that can impact both landlords and tenants financially. Understanding the terms of your lease agreement and seeking professional advice can help you avoid costly mistakes and disputes. By following the steps outlined in this article, you can calculate percentage rent accurately and effectively manage your finances.

Gallery

How To Work Out A Rental Yield: 3 Steps (with Pictures) – WikiHow

Photo Credit by: bing.com / yield

Calculator Par Percentage Kaise Nikalte Hain – GESTUKZ

Photo Credit by: bing.com / calculate calculator solve nikalte kaise hain exams

Percentage Calculator Free Tool – Check Percentage From Any Number

Photo Credit by: bing.com /

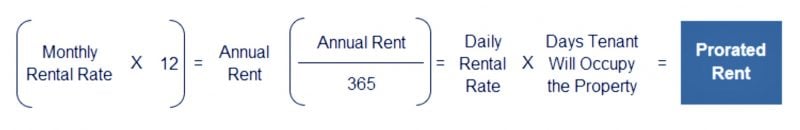

Rental Prorate Policies And Calculating Prorated Rent

Photo Credit by: bing.com / prorated prorate

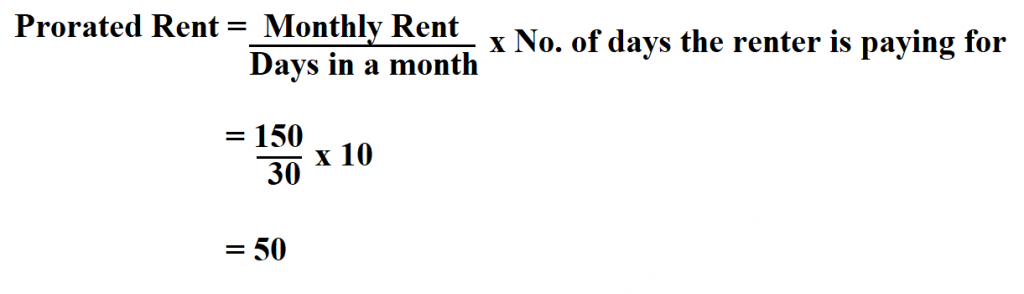

How To Calculate Prorated Rent.

Photo Credit by: bing.com / prorated rent calculate