Are you looking to calculate your percentage return on an investment? While it may seem like a daunting task, it’s actually quite simple with the right tools and knowledge. By understanding the basics of how to calculate percentage return, you can make more informed and strategic investment decisions.

When it comes to calculating your percentage return, there are a few common pain points that investors face. These may include not understanding how to factor in dividends or accounting for market changes over time. However, by taking a step-by-step approach and using relevant formulas, these pain points can be overcome.

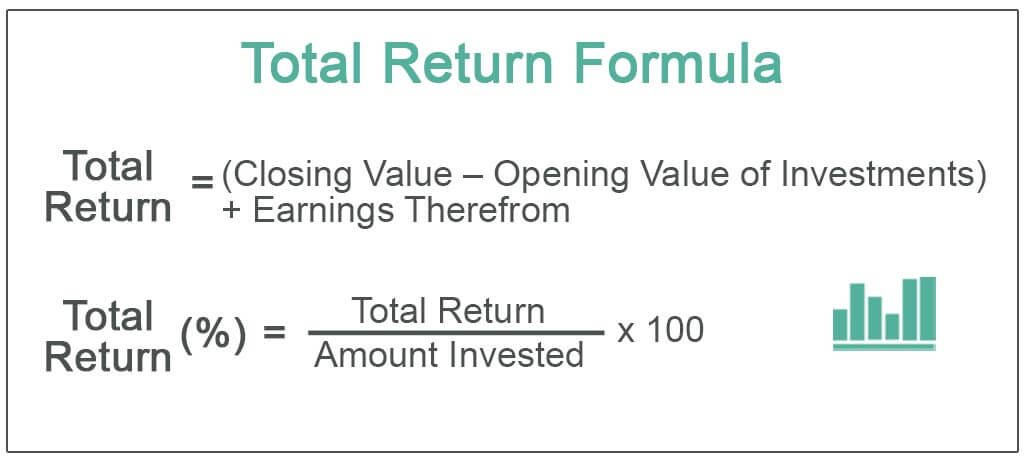

The basic formula for calculating percentage return is to take the ending value of your investment and subtract the beginning value, then divide that result by the beginning value. The resulting number can then be converted to a percentage. For example, if your investment started at $1,000 and ended at $1,200, the calculation would look like this: (($1,200 – $1,000) / $1,000) x 100 = 20%.

In summary, calculating your percentage return involves subtracting the beginning value from the ending value, dividing that result by the beginning value, and converting it to a percentage. However, there are nuances to this process that can impact the accuracy of your calculations.

How to Calculate Percentage Return: A Step-by-Step Guide

When I first started investing, I was intimidated by the idea of calculating my percentage return. However, I quickly realized that it’s a simple process with the right tools. To start, you’ll need to gather the relevant information about your investment, including its beginning and ending values, as well as any dividends or other income it may have generated over time.

Once you have this information, you can use the basic formula outlined above to calculate your percentage return. However, it’s important to consider any market fluctuations that may have impacted your investment over time. To get a more accurate picture of your returns, you may want to use a more advanced formula that factors in these fluctuations.

Factors That Impact Your Percentage Return

When calculating your percentage return, there are several factors to keep in mind that can impact the accuracy of your results. For example:

- Dividends: If your investment generates dividends, you’ll need to factor those into your calculations.

- Market changes: If the market has fluctuated significantly during the time you held your investment, your percentage return may be impacted.

- Fees: If you paid fees or commissions to buy or sell your investment, these costs should also be factored into your calculations.

The Importance of Regularly Calculating Your Percentage Return

One of the most important things you can do as an investor is regularly calculate your percentage return. By doing so, you can evaluate the performance of your investments and make informed decisions about where to allocate your funds moving forward. Additionally, tracking your percentage return over time can help you identify patterns or trends in your investment strategy.

Common Misconceptions About Calculating Percentage Return

Despite the relative simplicity of calculating percentage return, there are several misconceptions that investors may have about the process. For example, some may believe that the percentage return is the same as the rate of return or that dividends should be factored in differently. To avoid these misconceptions, it’s important to have a clear understanding of the basics of percentage return calculation.

Question and Answer

- Q: How often should I calculate my percentage return?

- Q: Do I need to factor in taxes when calculating my percentage return?

- Q: What’s the difference between percentage return and rate of return?

- Q: What’s the best way to account for market changes when calculating my percentage return?

A: It’s a good idea to calculate your percentage return at least once a year, if not more frequently. This will allow you to monitor your investments and make informed decisions about where to allocate your funds.

A: Taxes can impact your returns, so it’s important to consider them when making investment decisions. However, they do not need to be factored into your percentage return calculations specifically.

A: Percentage return and rate of return are often used interchangeably, but rate of return typically refers to the total gain or loss on an investment, while percentage return specifically measures the return as a percentage of the initial investment.

A: There are several ways to account for market changes when calculating your percentage return, including using a weighted average or annualized return formula.

Conclusion of How to Calculate Percentage Return

Calculating your percentage return on an investment is a critical component of being a successful investor. By understanding the basic formulas and factors that impact your returns, you can make informed and strategic investment decisions that will help you reach your financial goals.

Gallery

How To Calculate Percentage Return On Investment In Excel

Photo Credit by: bing.com /

Total Stock Return – Formula (with Calculator)

Photo Credit by: bing.com / calculator annualized dividends

Total Return Formula | How To Calculate Total Return? (Examples)

Photo Credit by: bing.com / calculate invested

Annualized Investment Rate Formula – Investment Mania

Photo Credit by: bing.com / annualized wikihow menghitung berechnen rendite pengembalian portofolio beispiel ucamn encrypted tbn0 convert

How To Calculate Return On Investment – Global Investor Network

Photo Credit by: bing.com / calculate percentage