Are you tired of not understanding how to calculate percentage tax? Do you find yourself struggling to figure out how much you owe come tax season? Look no further, as this article will provide you with all the information you need to calculate percentage tax with ease!

Calculating percentage tax can be a daunting task for many individuals. It requires not only an understanding of percentages but also an understanding of various tax laws and regulations. Some common pain points include not knowing how to calculate tax on different types of income or not having a clear understanding of which deductions can be applied when calculating tax owed.

The target of calculating percentage tax is straightforward. It involves determining the percentage of an individual’s income that must be paid to the government as tax. This percentage can vary depending on the level of income earned and the specific tax laws applicable to the individual.

In summary, calculating percentage tax involves determining what percentage of your income must be paid to the government as tax. It requires an understanding of various tax laws and regulations, and it can be challenging to navigate for many individuals.

How to Calculate Percentage Tax and its Target

As an independent contractor, I have had to learn how to calculate percentage tax on my own. At first, it was daunting to me, but as I started to learn more, it became a lot easier. First, you need to determine your taxable income, which includes any income you have earned throughout the year, minus any applicable deductions.

Next, you will need to determine your tax bracket, which varies based on your income level. Once you know your tax bracket, you can multiply your taxable income by the corresponding tax percentage to determine how much tax you owe. It’s important to note that different types of income can be taxed differently, and there are various deductions and credits that can impact the final tax amount owed.

The Importance of Understanding How to Calculate Percentage Tax

Understanding how to calculate percentage tax is crucial for anyone who wants to have a clear understanding of their financial situation. It allows individuals to know exactly how much they owe in taxes and can help them plan for the future accordingly. Additionally, having this knowledge can help individuals make informed decisions when it comes to tax planning and investment strategies.

Factors That Can Impact How to Calculate Percentage Tax

There are several factors that can impact how to calculate percentage tax. One significant factor is the specific tax laws applicable in the individual’s location, as these laws can vary significantly from one place to another. Additionally, income level, deductions, and credits can all impact how much tax an individual owes, making it essential to have a clear understanding of these factors before attempting to calculate percentage tax.

The Role of Tax Planning in Calculating Percentage Tax

Tax planning is an important tool that can help individuals minimize their tax burden and maximize their financial situation. By understanding different tax deductions, credits, and other strategies, individuals can reduce their taxable income and owe less tax overall. It’s essential to work with a qualified tax professional to develop a tax planning strategy that works for your specific financial situation.

Personal Experience with Calculating Percentage Tax

As an independent contractor, I have had to learn how to calculate percentage tax on my own. At first, the process was challenging and overwhelming, but as I began to learn more, it became a lot easier. By understanding my taxable income and tax bracket, I was able to calculate my percentage tax owed and develop a tax planning strategy that worked for me.

Question and Answer about How to Calculate Percentage Tax

Q: Is there a difference between tax credits and tax deductions?

A: Yes, tax credits and tax deductions are two different things. Tax deductions reduce your taxable income, while tax credits are a dollar-for-dollar reduction in the amount of tax owed.

Q: What is the best way to determine my tax bracket?

A: The easiest way to determine your tax bracket is to use an online tax calculator or speak with a qualified tax professional.

Q: Are there any deductions that are available to everyone?

A: Yes, the standard deduction is available to all taxpayers and can significantly reduce your taxable income.

Q: Can tax planning really make a difference in how much I owe in taxes?

A: Yes, tax planning can significantly impact how much you owe in taxes. By developing a tax planning strategy that works for your specific financial situation, you can reduce your taxable income and owe less tax overall.

Conclusion of How to Calculate Percentage Tax

Calculating percentage tax can be a challenging task, but it’s essential for anyone who wants to have a clear understanding of their financial situation. By understanding different tax laws, deductions, and credits, individuals can reduce their tax burden and maximize their financial situation. Working with a qualified tax professional is always recommended to develop a tax planning strategy that works for your specific situation.

Gallery

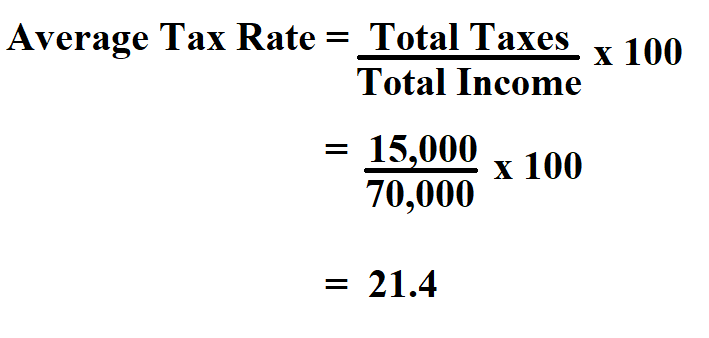

How To Calculate Average Tax Rate.

Photo Credit by: bing.com / tax calculate liability

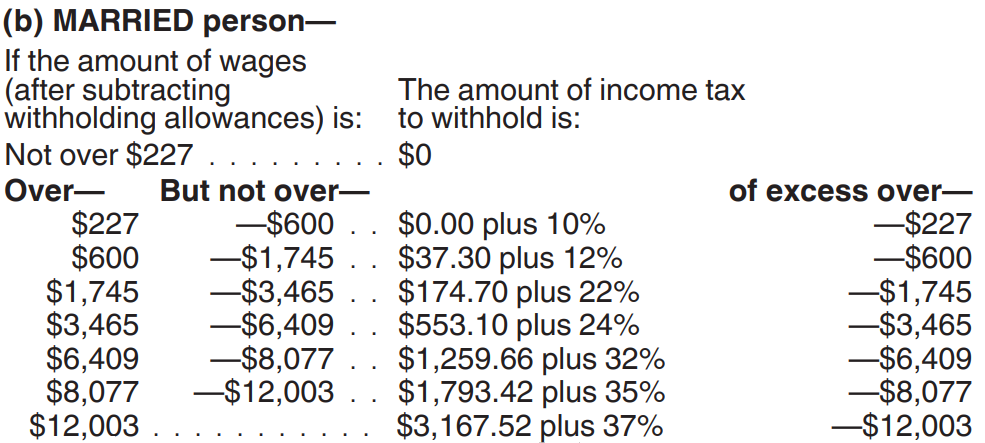

Education Information: How To Calculate Tax Percentage From Tax Amount

Photo Credit by: bing.com /

How To Find Out Percentage Of TAX On Calculator Easy Way – YouTube

Photo Credit by: bing.com / percentage calculator

How To Calculate Payroll And Income Tax Deductions – PEO & Human

Photo Credit by: bing.com / deductions payroll

Ex: Find The Sale Tax Percentage – YouTube

Photo Credit by: bing.com / tax percentage find ex