Are you interested in learning how to calculate percentage vat? As someone who frequently deals with financial data, calculating percentage vat is an essential skill to have. Whether you’re a business owner, an accountant, or just someone who wants to learn more about financial calculations, this post will give you all the information you need to master the skill of calculating percentage VAT.

Calculating percentage VAT can be a complex and time-consuming task, especially for those who have limited experience in financial calculations. It requires knowledge of formulas and a basic understanding of VAT rates. For many, this can be a source of stress and confusion.

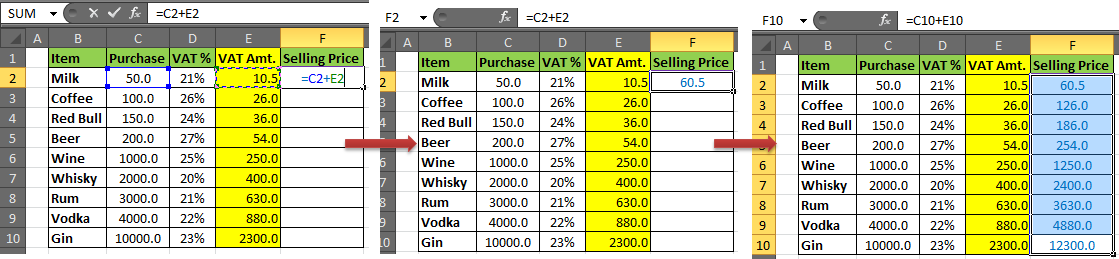

The first step in calculating percentage VAT is to understand the formula used. To calculate VAT, you need to multiply the net price of a product or service by the VAT rate. The VAT rate is usually listed as a percentage, and it’s important to check whether your country has a standard VAT rate or if there are different rates for different products or services.

To summarize, calculating percentage VAT involves multiplying the net price of a product or service by the VAT rate. This will give you the total VAT amount that needs to be added to the net price to get the final price of the product or service.

My Personal Experience with Calculating Percentage VAT

When I first started dealing with financial data, calculating percentage VAT was one of the most challenging tasks I faced. I found myself spending a lot of time double-checking calculations and ensuring that I had the correct VAT rate for the product or service in question.

However, with practice and experience, I was able to master this skill. I now find it much easier to calculate percentage VAT and feel more confident in my financial calculations overall. To anyone struggling with this task, my advice is to keep practicing and to not be too hard on yourself – it takes time to learn!

Common Mistakes When Calculating Percentage VAT

One common mistake people make when calculating percentage VAT is forgetting to include the correct VAT rate. This can lead to incorrect calculations and potential financial losses. It’s essential to double-check the VAT rate before starting your calculation.

Another common mistake is not rounding up or down correctly when dealing with VAT amounts that include decimal places. This can lead to minor discrepancies in your calculations, but over time, these discrepancies can add up and become significant.

Tips for Calculating Percentage VAT

Some tips for calculating percentage VAT include using a calculator with built-in VAT functions, double-checking the VAT rate, and taking the time to round up or down correctly. It’s also helpful to keep a record of your calculations for future reference.

The Importance of Knowing How to Calculate Percentage VAT

Knowing how to calculate percentage VAT is essential for anyone dealing with financial data. It allows you to make accurate calculations and avoid potential financial losses. Additionally, it’s a useful skill to have when starting a business or when working in a financial capacity.

Conclusion of How to Calculate Percentage VAT

In conclusion, calculating percentage VAT can be a complex task, but with the right formula, knowledge of VAT rates, and consistent practice, anyone can master this skill. Remember to double-check your VAT rates, round up or down correctly, and keep a record of your calculations for future reference. By following these tips, you’ll become a pro at calculating percentage VAT in no time!

Question and Answer:

What is the correct formula for calculating percentage VAT?

The correct formula for calculating percentage VAT is to multiply the net price of a product or service by the VAT rate.

What happens if I forget to include the correct VAT rate?

Forgetting to include the correct VAT rate can lead to incorrect calculations and potential financial losses. Always double-check the VAT rate before starting your calculation.

Is it important to round up or down correctly when dealing with VAT?

Yes, it’s important to round up or down correctly when dealing with VAT amounts that include decimal places. Failure to do so can lead to minor discrepancies in your calculations.

Why is knowing how to calculate percentage VAT important?

Knowing how to calculate percentage VAT is important for making accurate financial calculations and avoiding potential financial losses. It’s also a useful skill to have when starting a business or working in a financial capacity.

Gallery

How To Calculate VAT In Excel | VAT Formula | Calculating Tax In Excel

Photo Credit by: bing.com / vat excel calculate formula tax price calculator cost profit purchase

How To Calculate VAT In Excel | VAT Formula | Calculating Tax In Excel

Photo Credit by: bing.com / calculate calculating formulas

How To Calculate VAT In Excel |calculate VAT In Excel | Value Added Tax

Photo Credit by: bing.com / vat excel calculate

How To Calculate VAT In Excel? – Quora

Photo Credit by: bing.com / vat calculate excel calculations check

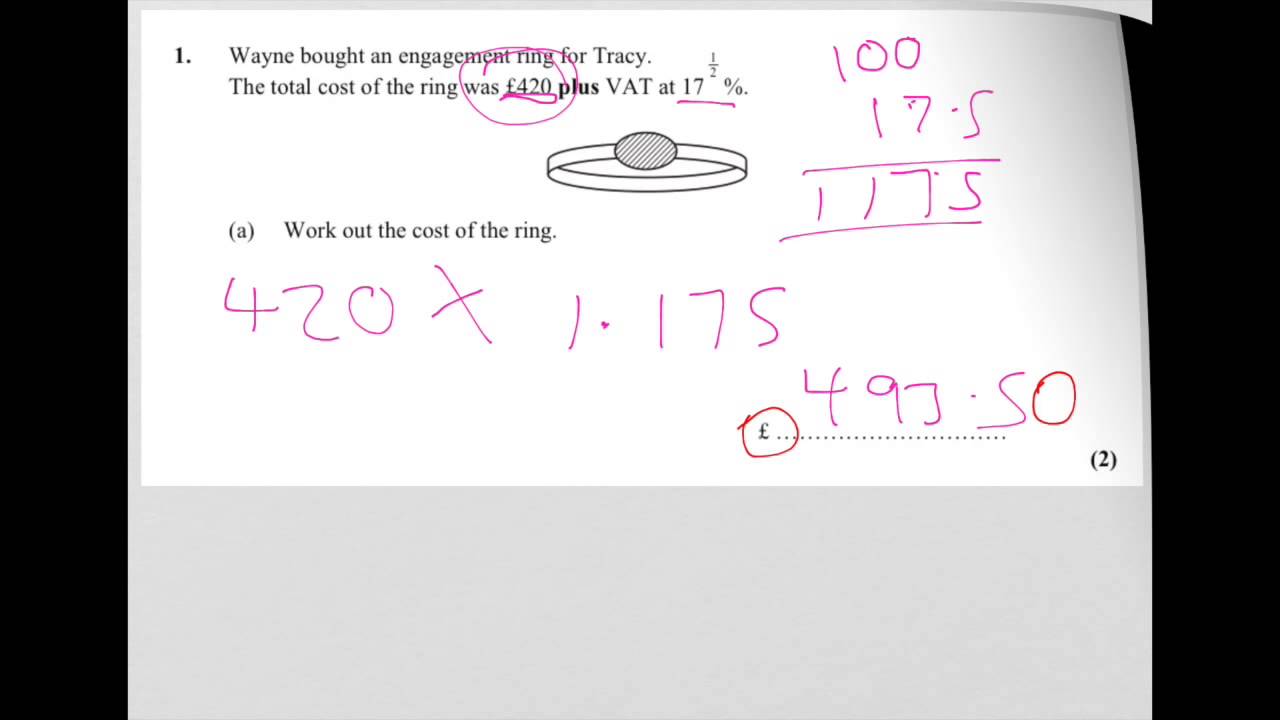

VAT Percentage Increase – YouTube

Photo Credit by: bing.com / vat percentage increase