Are you struggling with calculating the percentage withholding in your payroll? It can be a daunting task, especially for small business owners who do not have a background in accounting. If you’re tired of spending countless hours on this task, keep reading to learn some easy steps to calculate percentage withholding!

Calculating percentage withholding can be a tricky task, and mistakes can lead to hefty fines and penalties. This is one of the reasons why it’s crucial to ensure that you understand the process of calculating percentage withholding.

How to Calculate Percentage Withholding

The first step when calculating percentage withholding is determining the gross pay. This refers to the employee’s total pay before any taxes or deductions. Once you have this figure, you can then calculate the amount of withholding by multiplying the gross pay by the withholding rate.

The withholding rate is determined by the employee’s tax bracket and the number of withholding allowances they claim. You can use the IRS withholding tables to find the correct amount of withholding for each employee.

Once you have calculated the amount of withholding, you can then subtract it from the gross pay to determine the employee’s net pay. This is the amount that the employee will receive after taxes and other deductions.

Benefits of Understanding Percentage Withholding

By understanding how to calculate percentage withholding, you can ensure that your payroll is accurate and that you comply with all relevant tax laws. Additionally, you can save time and money by avoiding costly mistakes that can result in fines or penalties.

Common Mistakes to Avoid

One common mistake when calculating percentage withholding is using the wrong tax bracket or withholding rate. It’s essential to verify that you’re using the correct information for each employee to avoid errors. Another common mistake is failing to update your calculations when tax laws change. It’s essential to stay up-to-date with any tax law changes and adjust your calculations accordingly.

Automating Your Percentage Withholding

One way to save time and avoid mistakes when calculating percentage withholding is by automating the process. Many payroll software programs can calculate withholding for you, which can save you time and ensure accuracy.

Double-Check Your Work

Even if you are using automated software, it’s still crucial to double-check your work to ensure that everything is accurate. This can help you identify any errors and avoid costly mistakes.

Conclusion of How to Calculate Percentage Withholding

Calculating percentage withholding can be a daunting task, but it’s essential to ensure that you comply with tax laws and avoid costly mistakes. By following the steps outlined in this article, you can save time, money, and ensure that your payroll is accurate.

Question and Answer

Q: How often should I recalculate my percentage withholding?

A: You should recalculate your percentage withholding whenever tax laws change or when an employee’s tax status changes, such as getting married or having a child.

Q: Can I calculate percentage withholding manually?

A: Yes, you can calculate percentage withholding manually, but it can be time-consuming and prone to error.

Q: What happens if I make a mistake when calculating percentage withholding?

A: Mistakes when calculating percentage withholding can result in fines and penalties. It’s essential to double-check your work and stay up-to-date with any tax law changes.

Q: Can I use payroll software to calculate percentage withholding?

A: Yes, many payroll software programs can calculate percentage withholding for you, which can save you time and ensure accuracy.

Gallery

Calculating Withholding Allowances | Contractor Licensing Blog

Photo Credit by: bing.com / withholding allowance percentage method allowances calculating amount table number contractor value name year

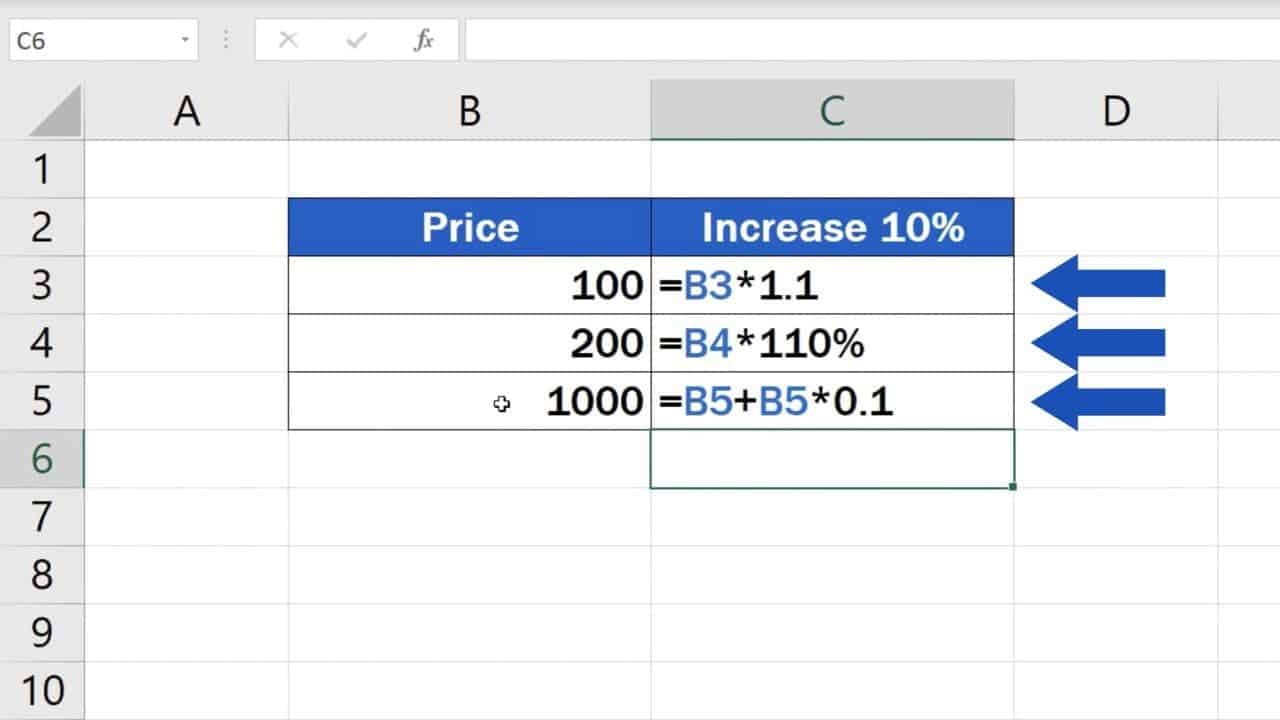

How To Calculate Percentage Increase In Excel

Photo Credit by: bing.com / calculate easyclickacademy umemaro formulas mentioned

How To Calculate Percentage: Solve Through Percentage Formula

Photo Credit by: bing.com / percentage calculate formula solve through

How To Find Percentages Of A Number

Photo Credit by: bing.com / calculate number percent find numbers change percentage percentages increase excel between two

Withholding Taxes: How To Calculate Payroll Withholding Tax Using The

Photo Credit by: bing.com / withholding tax percentage calculate payroll method federal taxes tables employee wage bracket using