Are you concerned about how to calculate percentage yearly income? Understanding how to calculate your yearly income percentage is critical when planning your financial future. It can help you know if you’re on track to meet your financial goals and make sure you’re not overspending your income. Keep reading to learn more.

Calculating your yearly income percentage can be a jarring experience. It can be shocking to see how much income tax you pay, and how much you have left after all the deductions. Furthermore, the process can be confusing and difficult, leaving many people wondering if they did it correctly.

Calculating your yearly income percentage is relatively simple if you follow some basic steps. Begin by calculating your total income, including any bonuses or other payments you received throughout the year. Next, add up all your deductions, such as taxes and retirement contributions. Finally, divide your deductions by your total income and multiply the result by 100. The final number is your yearly income percentage.

In conclusion, calculating your yearly income percentage is an essential aspect of financial planning. While it can be a daunting task, it is a necessary one to ensure your financial stability. Understanding how to calculate it correctly can help you plan for your future and make sure you are living within your means.

How to Calculate Percentage Yearly Income and Its Target

When calculating your yearly income percentage, the objective is to have a clear picture of your financial status. It indicates the amount of tax you pay and deductions, allowing you to make informed decisions to manage your finances better. In my personal experience, learning how to calculate my yearly Income percentage gave me a sense of control over my finances, reducing financial stress.

The formula for calculating your yearly income percentage is dividing your deductions by your total income and multiplying by 100. For instance, if my total revenue is $80,000 and my deductions are $20,000, my yearly income percentage is 25% ((20,000/80,000)x100).

If you’re not a math person, using annual income calculators can help make the process more straightforward; many are available online, and you can use them for free. Additionally, it would help if you kept track of all your income and deductions throughout the year to avoid any surprises while calculating your income percentage.

Strategies to Improve Your Yearly Income Percentage

Improving your yearly income percentage can be challenging, but the benefits of doing so are worth it. One way to increase your income percentage is to reduce your fixed expenses by cutting costs, such as rent or your monthly subscription services. Additionally, you can increase your income by taking on a side job or starting a small business. A higher income and lower expenses skyrocket your income percentage and provide you with more money to save or invest.

Tips for Identifying Deductions and Reducing Tax

To improve your income percentage, identifying your deductions and reducing your tax liability is crucial. Before you start the process, research your tax laws to learn what you can deduct. Some deductible expenses include home office expenses, charitable donations, education expenses, and retirement plan contributions. Identifying what’s deductible and reducing your tax liability allows you to save more of your income and increase your percentage.

Frequently Asked Questions

- Q: Can I use online calculators to calculate my yearly income percentage?

- A: Yes, many online calculators are available and free to use. Using them is an easy and reliable way to calculate your percentage.

- Q: Can reducing my expenses increase my yearly income percentage?

- A: Yes, cutting your monthly expenses can increase your income percentage. Reducing your expenses allows you to keep more of your money and can free up funds to save or invest.

- Q: How can I reduce my tax liability?

- A: Identifying your deductible expenses and making charitable donations are two ways to reduce your tax liability; be sure to research your tax laws, as some expenses can be deductible.

- Q: Is it necessary to calculate my yearly income percentage?

- A: Yes, understanding your yearly income percentage is essential for financial planning. It helps you know if you’re on track to meet your financial goals and make sure you’re not overspending your income.

Conclusion of How to Calculate Percentage Yearly Income

Calculating your yearly income percentage is essential for financial planning, and understanding how to do so can help you meet your financial goals. By understanding the formula to calculate your percentage, taking measures to increase your percentage, and reducing your tax liability, you can keep more of your income and start building a healthy financial future.

Gallery

Income: 5 Easy Ways To Calculate Your Annual Income

Photo Credit by: bing.com / calculate calculating

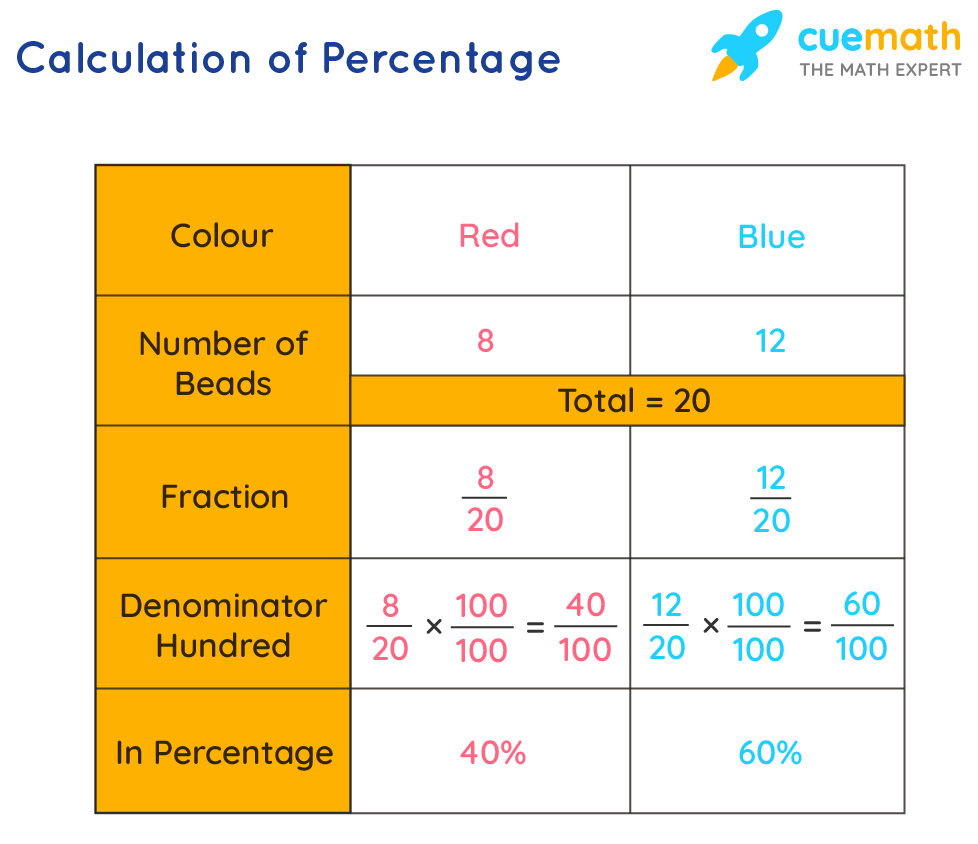

Percentage – Examples | How To Calculate Percentage?

Photo Credit by: bing.com / percentages calculation calculate

Annual Income – Learn How To Calculate Total Annual Income

Photo Credit by: bing.com / income annual calculator calculate total example accounting template

How To Find Percentages Of A Number

Photo Credit by: bing.com / calculate number percent find numbers change percentage percentages increase excel between two

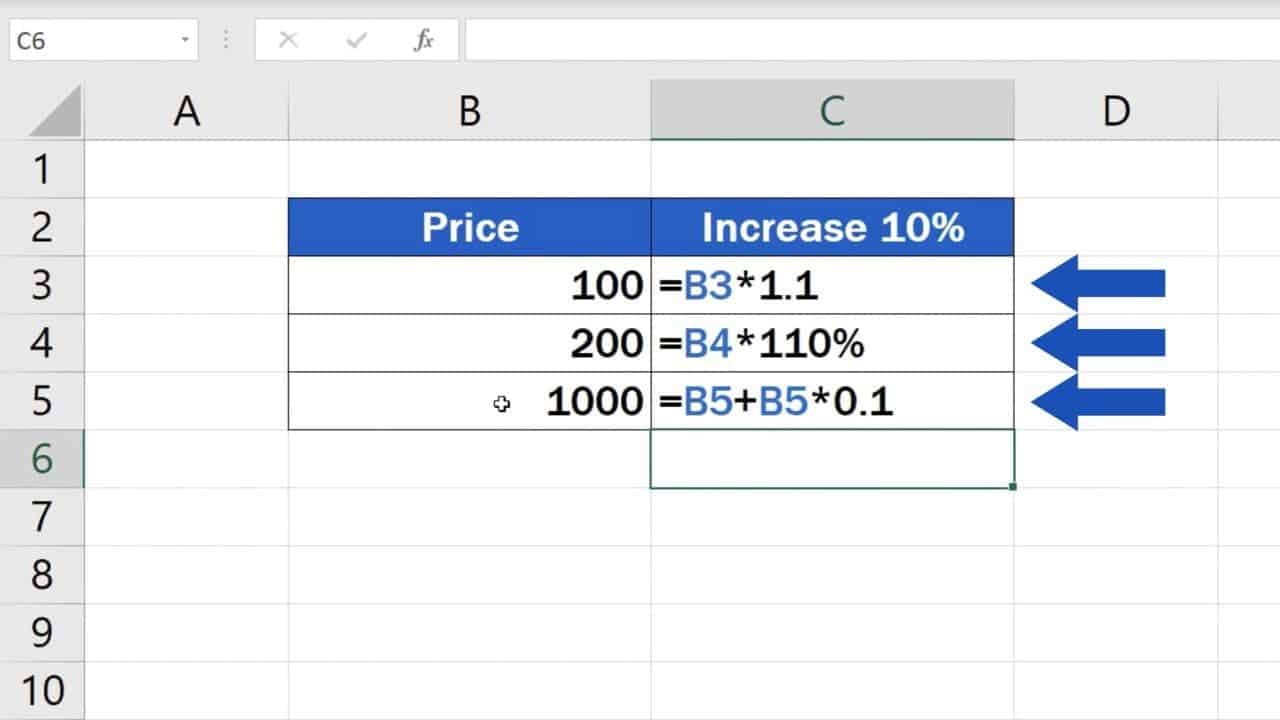

How To Calculate Percentage Increase In Excel

Photo Credit by: bing.com / calculate easyclickacademy umemaro formulas mentioned